August 2020 will mark my 7-year anniversary of living in Colombia as a resident – soon to become citizen.

I’ve always loved real estate, but in northern Europe, just before the crash in 2008, prices were so inflated that properties were being sold with a negative yield. That meant taking money out of your pocket every single month – even if you have a fully rented building – to pay for the mortgage, property tax, maintenance and so forth. Because the rental income alone would not be enough to cover these expenses. It was an impossible market to enter as a newbie without experience and a big net worth. And most people who did enter at the height of the market ended up getting burnt. Badly.

In Colombia, and particularly in Cali, I discovered the cheapest market I had ever seen. But each market has its learning curve, its pitfalls, pros and cons.

For the first 2 years, I didn’t earn a peso in Colombia. I was living mostly off savings and losing money on different business ventures – including a big loss on our first investment property which I wrote about here.

It took time to learn the language, explore the city (and country), establish good contacts with realtors, contractors, lawyers, accountants, the notary, and the zoning office.

I must have visited at least 300 properties. Houses, apartments, buildings, farms, and lots.

Here’s a picture post-renovation of the first succesful investment we made.

It was a 79 m2, 2-bed, 2-bath apartment on the 4th floor with no elevator or parking lot. But the location was (and still is) prime, half a block from El Peñon park – one of the nicer entertainment districts in Cali.

We bought it from an old lady who couldn’t climb the stairs anymore. It was outdated and had to be renovated which took about 3 months with a crew of local contractors.

Upon completion, we began renting it on Airbnb. I thought we had it all figured out, as you can see from this post. That went well for a year or so until the neighbors and the homeowners association began complaining about the high flow of partying tourists in the building. It became such a pain in the butt to deal with that eventually we decided to sell it.

Now, 5 years down the road from that first experience, and all I can say is that I’ve learned a LOT. The design, the execution of the renovation, the furnishing, to the pictures, property management and the whole structure of the deal. Everything has been improved and taken to the next level.

Here’s a picture of one of the units that we finished in 2018.

Since 2015, I’ve completed 41 apartment renovations and currently have a building with 12 units undergoing a complete gut-job, including a structural reinforcement, adding a partial 3rd floor, changing all electrical installations, all plumbing, all windows, the entire roof, all ceilings, all carpentry, making an underground water reserve, installing a hot water recirculating system on the roof, adding air conditioners to all spaces, smart lock, WiFi, cameras, etc. It’s a fairly big undertaking. Here’s what it looks like today, about halfway through the construction.

On top of all the practical and technical aspects of managing a construction site comes the legal part that includes setting up a company with the best structure for our investors. Then dealing with accounting, construction permits, bringing in funds from abroad, registering them correctly, and so forth.

Every obstacle, hiccup and challenge taught me something valuable. And the idea with this post is to help you save time and money by avoiding some of the many mistakes that I committed along the way. While it would be impossible to list every single thing that I’ve learned along the way, here are some of the most important lessons that stick out and are worth having in mind as a foreigner buying real estate in Colombia.

Almost anything can be negotiated

I never grew up being a hard negotiator. It just isn’t part of our culture. In Denmark, we tend to assume that whatever is being sold to us is listed at a fair price.

Colombia is quite the opposite. Sellers tend to list assets high because they are preparing themselves to meet a hard negotiating buyer. Everybody here asks for a discount. Even at the bakery people ask for the ñapa and hope that it will result in an extra pandebono. It’s not rude. It’s cultural, and expected.

So don’t be ashamed to bargain. Always ask sellers of properties, lawyers, architects, and accountants or anyone else for a discount, until you reach that magical win-win equilibrium. And remember, it should be done with a smile. There is no need to offend anyone.

Title study and “promesa”

This concept is unknown to us in northern Europe. But in Colombia, it is of the outmost importance – and even more so as a foreigner – that you NEVER purchase any type of property without having a lawyer, that specializes in real estate transactions, review the documentation.

There are several reasons for that. The main one being to verify that the current and previous owners have not been involved in criminal activity, which will expose the property and the new owner to a list of potential risks such as:

- Government confiscation.

- That whoever that criminal person was will come back and ask to have the property returned to his name. Let’s say it was in the name of a third party for money laundering reasons, but that person sold it off while the criminal served time in jail.

- It will be almost impossible to sell in the future, unless that criminal person and all relatives plus business associates have died. Because no Colombian will touch it. The only exception to this rule is if the government is auctioning this property off with a clean title, although that alone is enough to prevent many potential buyers from wanting to buy it.

Other reasons include making sure that the property lines on title correspond to the lines in the public title registry, and to make sure that there are no unknown debts or liens held against the property.

Finally, it makes sense to have that same lawyer help you draft the purchase contract known as the promesa. It spells out all the details of the agreement. You will want a contract that protects you and your interests in the event of a dispute with the seller.

Bringing in your funds correctly from abroad

If the money that you plan on using for the purchase of a property is currently held on a foreign bank account, then, in order for you to avoid future problems, you will need to bring those funds into Colombia correctly.

By correctly, I mean via a financial entity such a bank or brokerage firm in Colombia that has been authorized to deal with the sale and purchase of foreign currencies.

Please do not try to bring cash, sell Bitcoin in Colombia to raise cash, wire money to a friend’s account or anything along those lines.

Upon receiving the money in your bank account here, you will need to fill out a form – F4 – that gets filed with the central bank to document the foreign investment. Do not trust the bank to fill out this form. They are not legal experts and the fine for getting it wrong is up to 200% of the funds that you are actually bringing in. Invest in a lawyer who specializes in “derecho cambiario”. It might cost $100-200 USD but it is money well spent.

Just to give you an example, the process for filling the form is completely different if you are buying in your own name vs. buying in the name of a legal entity. A small mistake that almost got me in big trouble.

Finally, if you forget to fill out this form, you will most likely end up having trouble getting your funds out of Colombia upon selling the property in the future.

Always get the price your pay for the property on title

Colombian sellers almost always try to declare a lower value on title when selling a property. And most Colombian buyers tend to agree. It helps them lower transaction costs, capital gains taxes, etc.

But you – as a foreigner – must not participate in such shenanigans. Here’s why.

First off, it was just recently made illegal practice to modify the price on the title. Second, the form that you fill out with the central bank (mentioned above) includes the peso amount of your investment. That amount must correspond the to the value on title. Remember the fine for getting the form wrong? Yes – that’s why!

Finally, if you plan to apply for either the Migrant or Resident visas using your real estate investment as the classifier, then you will have to document the price of your purchase – both via the new title, but also via bank statements and the forms presented to the central bank.

Local architects for local permits

If you plan on building from scratch or undertake a renovation that changes the use, layout or size of a building, then you will need to get a construction permit via the zoning office called a “Curaduria“.

The zoning and regulation in every single city is different. An architect from Medellin might be very talented, but if he doesn’t know how many parking lots the city of Cali requires for a residential building, then you will end up paying a local architect to make sure your plans comply with local regulation before applying for a construction permit.

Here’a pro tip – make the people at the zoning office your friends. All of the architects I have met that work for the Curaduria, are in essence contractors for the city. And they love making some extra money. Even the head of the Curaduria – which is a private company scrutinized but the City Planning Authority – likes it when the architects on the floor bring in extra business. Ask anyone of them if they are able to help you with your plans to make sure they comply with local regulation. Worst thing that can happen is a no – but in that case you can always ask for a referral to someone who can help you. There is nothing corrupt about this, it’s simply working with the people who knows the regulation the best.

Financing in Colombia is still too expensive

The interest rate for a 15 year loan to buy an apartment is currently (July 2020) 9.80% per year with Bancolombia – one of the biggest banks in the country. You will need a 30% down payment and proof of income in Colombia to support the monthly payments. Some other banks charge up to 14% interest year. While you may be willing to pay this much if buying your personal residence, interest rates this high will eliminate any chance of producing reasonable profit on a real estate investment. Over the course of those 15 years, you’ll end up paying for the house two times over. What are your chances of earning any sort of positive cash flow during such a period or even capital gains by the end of the repayment of such a loan? ¡No bueno!

This year, due to the COVID-19 pandemic, the Colombian central bank has lowered rates from 4.25% to 2.5%. Unfortunately, it doesn’t seem like these reductions have made their way to consumers yet. That might change, but for now, I would recommend that you avoid getting into debt in Colombia.

Foreign banks, such as Caye Bank in Belize will offer a loan to foreigners in many countries, but the interest rate is almost the same.

For now, Colombia remains a cash market in my opinion – unless you have access to cheap credit in Europe or North America. But be careful…

The Colombian peso is volatile, and currently very weak. When I arrived in 2011, the USD/COP was $1800. Today, it sits around $3600. So the peso has depreciated about 100% against the dollar. While great for anyone earning dollars and spending pesos, it is devastating for anyone in Colombia who earns pesos and who are trying to pay back a loan in dollars.

The only exception to this is if you have an income in dollars to eliminate this risk.

If you work with investors from abroad who have USD or EUR to invest, then now is a great time to consider buying as the value is very hard to beat.

Colombia is no tax haven… quite the opposite

Here are the quick facts…

Personal income tax in Colombia is progressive and rages from 0-39% depending on your income.

Corporate taxes are 32% for 2020 and will fall to 31% in 2021 before settling on 30% in 2022.

Taxes on dividends ranges from 0-10% depending on the how much is being distributed.

On top of that comes 4×1000 (0.4%) tax on financial transactions. A tax on gross revenue known as ICA, as high as as 13.8×1000 (1.38%) depending on the municipality and the activity.

But tax evasion is almost like a sport in Colombia. Only about 5 million people out of approximately 50 million pay income taxes here. For that reason, the government levies high taxes on consumption (19% sales tax), along with fairly high taxes on property, roads, gasoline, vehicles and imported goods.

Finally, even after paying all these taxes, you still have to come out of pocket for premium health care and quality education for your children.

In essence, don’t come to Colombia because you see it as a tax friendly jurisdiction. On a daily basis, once you begin adding it all up, it really feels like you’re getting fleeced, especially because you get very little in return from the government. You should come for the lifestyle. Because you love the country, the nature, the culture, the diversity, and its folkloric people.

Renovations have usually been executed in the cheapest way possible

Colombia has high standards for structural design and electrical installations. But it doesn’t always mean that they get implemented in practice. More often than not, especially with smaller projects, you will find that there’s a difference between what was approved on the official plans and what was actually executed. If in doubt, then have an engineer or architect help you review the documentation and building with you. The people from zoning and planning offices rarely visit construction sites and thus make it easy to circumvent the rules.

But it also shows in less important areas…

In general, investments are driven by rational decision making processes. For the most part, people consider how long will it take to recover their investment. Real estate is no different. So, for instance, when someone is trying to sell you a property that they have just renovated, they will try to recover their investment… and then some. That doesn’t have to be a bad thing. Someone invested their time and money, and for that effort, you pay a premium. Sounds good in practice, but the reality in Colombia is that the majority of people here, due to mostly low salaries, are very cost sensitive, and it reflects on the end result of their construction and refurnishing. I know this from first-hand experience after visiting hundreds of properties. What I’ve found, more often that not, is that renovations – and even newer constructions – usually built on a tight budget or with the purpose of flipping to another buyer – have been built cutting corners and with inferior materials. You will notice immediately if you pay attention…

Did they neglect to install an extractor in a kitchen?

Did they forget to install hot water pipes?

Are the doors on the brand-new closets hanging in the hinges?

Are the apartment doors so thin that you can hear someone fart in the hallway?

Do the windows not seal properly?

Is humidity starting to show around the windows, wall and facade?

Does it look like there was a leak in the ceiling?

Did they pull the new electrical wires outside the wall instead of tubing them inside?

The list goes on, but I think you get the point. The sad part is that seller wants a premium for all of the “improvements” he made to the place. But it makes no sense for you to pay it, if you have to re-do a big part of it. It depends on your personal standards, of course.

For the best results, work with specialists instead of generalists. Many contractors know a little about a lot, but not a lot about one thing – such as plumbing, electrical installations, brick work, etc.

I don’t want to sound like a snob, because that’s far from the case. I do, however, care deeply about the esthetics and functionality of a building… especially if we are committing a lot of money to that investment. For that reason, I prefer to buy a property in bad condition and upgrade it to my liking instead of buying something that is already “perfect” in the eyes of the seller.

Always change the roof when buying an old house or building

Have you ever experienced a torrential downpour in Colombia? It’s a beautiful experience. The smell and feeling of Mother nature is amazing. At least to me.

It happens quite frequently, and when it does, many streets flood along with nearby houses causing unwanted damage and unnecessary cleaning. But even if you’re lucky enough to not live on a road that turns into a creek when heavy rain hits, then you still risk having the water seep in from above.

Every single house, building or top floor apartment that I have purchased has had a leaky roof. This includes my current home which was built in the 1990s.

Just by looking at the fibre cement sheets and red clay tiles that make up the roof on most houses in Colombia, you can almost spot the cracks with the naked eye. But when I just began investing in Colombia, I never worried about having to deal with the roof. And most certainly didn’t have room for any fix in my budget.

But trust me, changing the roof and gutters is one of the investments you can make if buying an older property and it will save you plenty of potential future headaches. For practical reasons, I recommend a metal structure with sheets of thermo-acustic PVC. Plastic or galvanized gutters are the best and make sure the tube for discharging the water is at least 6 inches wide. Avoid the concrete gutters as they eventually end up filtering water. Same thing goes for wooden structures which are prone to rot and termites.

Here’s what it looks like before the drywall ceilings are installed:

If, for some reason you don’t have the budget to replace the entire roof or can’t go with a PVC solution due to an esthetic conflict that may arise if you house is located in a historic neighborhood, then at least do yourself a favor to have the roof thoroughly inspected for leaks and sealed where needed.

Final comment is to remember to clean the roof and gutters regularly, especially if there are any trees nearby. I’ve had the ceilings collapse and flood brand-new apartments because they gutters were clogged with leaves and dirt. Not fun!

Colombian real estate is best as a long-term investment

Flipping properties in Colombia is a losing proposition. There are several reasons for that:

First, the closing process is slow. Even after all the formalities of completing the title study, signing thepromesa, and finally the new title – known as the escritura – the title office itself (Oficina Registro de Instrumentos Publicos) can easily take anywhere from 15-60 days to finalize the process, depending on their workload, employees strikes, mistakes, inefficiencies, etc.

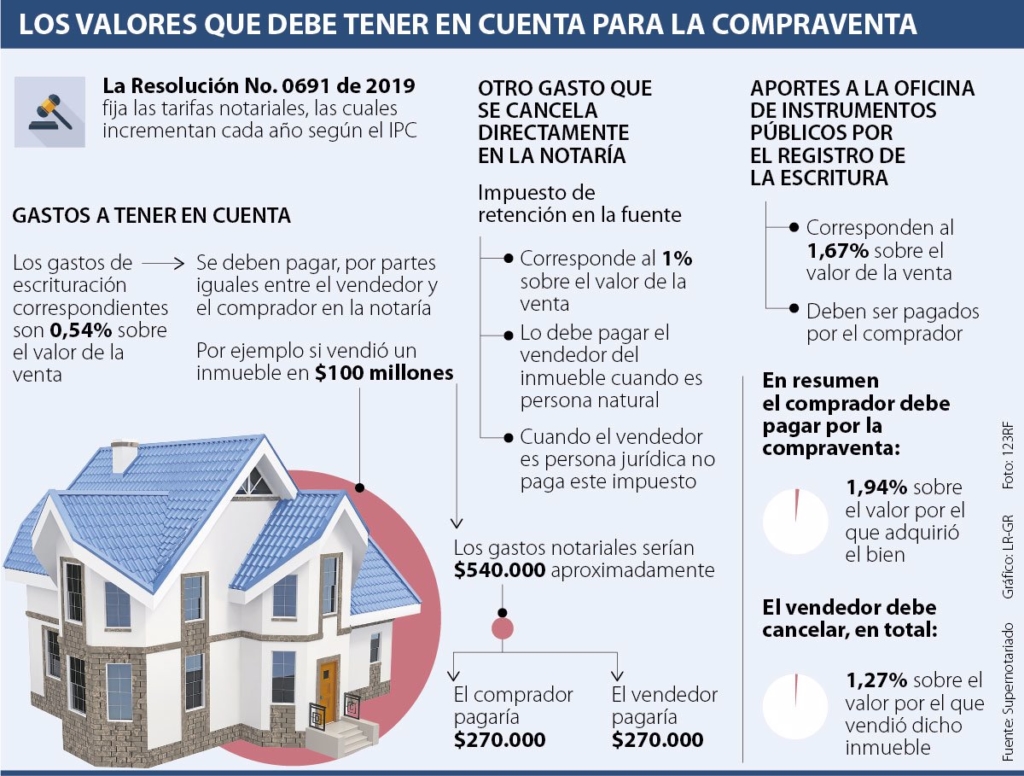

Second, a realtor commission of 3% (paid by seller) and closing costs of about 1.94% for buyer and 1.27% for seller will eat away from profit.

Third, and this is more important. When you hold a property for less than 2 years, then any profit is taxed as personal income in Colombia (up to 39% depending on your income that year), whereas capital gains tax, after owning the property for more than two years, is only 10% no matter your income bracket.

Fourth, the 1031 exchange that many Americans use to invest capital gains tax-free into a bigger property unfortunately doesn’t exist in Colombia.

Where to find the best returns

Before buying any property you will have to decide what you are looking for: a home, a vacation home, monthly cash flow, asset appreciation, etc.

Whichever category you fall into will determine what part of the market you should look at.

Buying high-end real estate in fancy neighborhoods might be great for a personal residence and appreciation, but if you’re planning to rent it out then you’re better served by looking elsewhere.

For instance, a friend of mine has a really nice house in an upscale neighborhood in Cali. It cost him $1700 million COP to acquire. Monthly HOA fees are $1 million. Property taxes are $10 million per year.

Yet, he will be hard pressed to rent it for more than $8 million per month – including the HOA fee. So let’s run the math…

($8M rent – $1M HOA) x 12 months = $84M per year. Then deduct the $10M property tax and you’re left with $74M on a $1700M investment. That’s a 4.3% return (if paying cash). And that assumes that you have a 100% occupancy. Any vacant months and you’ll quickly be looking at a lot less.

Bear in mind that you can get 4-5% interest on a bank account in Colombia with zero effort.

However, as a long-term permanent residence for my friend, he will most likely be making 4-8% in capital appreciation. But that, of course, is speculation.

I know another lady who lives in a modest house, in a safe but low-income neighborhood. She paid $70M for it. Her neighbor, living in an identical house, is renting and pays $650.000 per month. The property tax is only $150.000 per year.

($650K rent – $40K for guard on the street) x 12 months = $7.320M per year. Then deduct the $150K property tax and you’re left with $7.170M on a $70M investment. That equals a 10.2% return on the investment without even considering the potential appreciation. Add to it annual increases in the monthly rental paid by tenants due to inflation adjustments (around 3-4% p.a.) and things start to get real juicy. Plus the fact that the market for low-income housing has a lot more demand and is thus a lot more dynamic. This old lady tells me that as soon as someone moves out on her block, it rents to another family within days.

A little piece of advice. If renting long-term and to Colombians, whether it be high-end or low-end housing, I suggest that you hire a local company to administrate the unit for you. It will cost you a bit but they are very diligent and good at getting co-signers and signing a rental insurance policy to make sure that you ALWAYS get paid – even if the tenant and his co-signer defaults.

The way the world is changing right now, I would abstain from investing in commercial store fronts or office space until at least things have calmed down. My nose tells me that well-located parking lots is still a great business in Colombia and will continue to be so… but they are hard to come by and I rarely see any for sale.

So the best returns are currently found in the lower-end of the price range. The exception to this rule is when investing in short-term rentals for Airbnb and the likes. That’s the market I personally invest in. We looks for properties around entertainment districts that we can convert into high-end furnished rentals generating about 10-12% annual return on capital before any appreciation and apply tax advantages at the same time. But investing in the short-term rentals comes with a caveat…

Renting apartments short-term legally is complicated

Here’s why…

Cotelco is is the Colombian hotel association. They are very powerful and have been lobbying hard against the short-term rental industry, which they see as a threat to their business.

So, in 2011 the government passed legislation to “formalize” the short-term rentals by forcing them to oblige by the same regulation as the hotels. Even if you have only one unit. Some of the things you must comply with are…

- RNT – Registro National de Turismo. A certificate obtained from the chamber of commerce that gives you permission to offer services to tourist.

- Once you have been registered with the RNT, FONTUR, Colombia’s entity in charge of promoting tourism will begin collecting a new taxes based on 0.25% of you operational income.

- Even if renting you property as a private individual, you will have to register you economic activity with the chamber of commerce and on your tax ID.

- If your house or an apartment belongs to a residential community, then the HOA rules explicitly need to permit the use of the property for tourism for all owners. This has previously been almost impossible to comply with, but now they are beginning to develop project specifically for this purpose.

- The “Uso de Suelo” is a list of all the permitted activities on a given piece of land. If renting a house or furnished apartments short-term, then you will need to make sure that vacation rentals are allowed. They are classified as CIIU codes. You should check for 5511, 5512, 5519. Some cities allow you to verify this online. Others make you do it via the city zoning or planning offices.

- You will have to perform check-ins of all guests on the Migration website known as SIRE, which links to Interpol and warns the local authorities if anyone internationally wanted should stay at your property.

- You will have to get an annual inspection by the local fire fighters.

- You will have to obtain a sanitary register on an annual basis from the local government where they inspect how you handle garbage, pest control, water reserve tanks, etc.

- You will have to comply with the environmental regulation known as NTS002.

- You will have to notify all guests in your property of the Law 679 and 1336 which establishes a code of conduct for proper behavior and warns guests that the sexual exploitation of minors in Colombia can lead to 35 years in prison.

- Expect to get a visit from the Tourism Police a few times per year. They want to inspect your documentation and maybe even knock on a few doors in to verify that the ID of the guests correspond to what you have registered in their database. They also want to make sure that no minors are staying with you without their parents or legal guardian being present.

If this sounds like a lot of work to you, then you’re right. In fact, it’s a massive hassle… unless you have a great setup and team to help you streamline the process.

My estimate is that maybe 95% of all Airbnbs in Colombia are still technically illegal, but the police is beginning to crack down on them more frequently.

Make sure you owe the contractors money – not that they owe you labor

Contractors anywhere are always in a hurry to get paid. Many of them also like to get a cash advance for the job they are going to do. That is fine – but ONLY if materials are included in their price. If it’s only labor, then I suggest that you convince them to start working and pay them every 15 days according to progress.

Hiring a contractor with materials included is lot easier and saves you a bunch of time. The issue is that any contractor will be scared of miscalculating and thus usually end up quoting a price that is on the high side. In these cases, make sure you only give them enough money to buy materials.

If you plan to oversee the renovation of a project yourself and you’re just getting started, then I suggest that you find a contractor that you pay for labor and you provide the material. It takes time sourcing all the materials but the savings are significant, you will learn a lot, and you avoid having the contractor disappear with your money.

I also suggest that you, for bigger projects, sign a contract with your contractors where they commit in writing to the budget given, the timeline, and where they offer a 12-month warranty on the job. I usually retain the right to hold back payment of at least 10% of the contract until the project has been delivered to my complete satisfaction.

This is not too much to ask. And once contractors understand that you’re a straight shooter that pays on time and according to the agreement, then they will be happy to work for you.

Some of them will cry right before the weekend that they don’t have any money but if they haven’t finished what they agreed to then I suggest that you refuse any payment.

Keep track of expenses and find a good accountant

This is a given if you’re investing via a company. The books must be in order, always.

But when buying as an individual there’s also an added benefit of keeping track of all your expenses and saving all receipts because you can use those expenses to lower your capital gains taxes. But only if they are well-supported.

That’s it for now…

Feel free to add any questions, thoughtful comments or share your experiences the comments below.

If you are reading this and are considering an investment into Colombian real estate and would like more in-depth advice, help with deal analysis, negotiation or anything along those lines, then I’d be happy to do a private consulting session with you. You can reach me here.

If you are reading this and would like to know more about our current and upcoming projects in real estate and agriculture – and potentially investing alongside us, then please reach out to me here.

Great article Patrick! But let me ask you….how you solve the issue of high rates interest in Colombia? I am in Bogota with the idea of investing in rental apartments or multifamily buildings but is not easy to find opportunities with positive cash flow numbers…mainly due to that high cost of money from banks. Will appreciate your comments!

Hi Jaime,

Great question! Everybody’s situation will be different and we don’t all have the same options. I started out with a line of credit from Denmark, about $70.000 USD at 6% interest that my mom had to co-sign for. That, along with my savings was enough to get started with single apartments. But to take me to the next level, I had to work with investors who believed in me. That became a building with 4 units, then one with 7, then 8, then 19 and now the current project of 12.

In Colombia, everybody is affected by the high interest rates. Most construction companies build to sell individual units, never to own a building themselves. And they really don’t work with a lot of their own money. They usually reach an agreement with the owner of the land who allows them to build a demo house and pay them in installments according to progress in sales and construction… they might even pay the owner of the land with a few apartments.

Then they pre-sell apartments or houses until they reach a breakeven point, about 65-75% of all units. All funds from buyers go the escrow (fiduciaria) which handle disbursements according to progress in construction. So the only money the builder needed was maybe $200-400 million for the demo-house, an architectural design and a construction license.

So I agree – investing as a solo individual in rental apartments is hard unless you have a lot of cash. Buying entire buildings if you have the cash is equally hard because there are very few of them with only one owner – each unit has an owner. So in that respect, the Colombian real estate market is not as dynamic as one could hope for. Plus Bogota prices are really high. The easiest way to start is probably to start with lower strata housing where you entry point is a lot lower but you can still generate a decent return. That, or pool your funds with some investor friends to get started.

Hope this helps and good luck!

Patrick

Wow! Thanks for sharing insightful advice about Colombian Real Estate. I’m bookmarking this for when it’s time to buy a property.

I read them all… I also experienced many of this myself – This is the best, most accurate, thorough article about buying real estate in Colombia out there.

It made me think and re-think about some things

Thanks!

Awesome, glad you liked it, Lee!

Thanks Yoav – I’m sure you’ve felt some of this yourself. Keep pushing – I’ll be looking forward to see your house when it’s done.

Hello Patrick,

Great article. Thank you for sharing. Would you have any particular recommendations for resources for renting or eventually purchasing a small finca for retirement and possibly turning into a Eco lodge? Outside the city 20,000 to 40,000 meters.

We are looking for land to sink our toes into as we too enjoy the rich smell of Mother Earth. My partner is in hotel marketing and management, she has 15+ years experience working with the major players Travel companies like Expedia and AirBNB, and is also a digital creative, website, graphic design and illustrator. My background is 30+ years in technology sales, turned photographer and yoga instructor. So we have the “business “ side fairly covered, but what we lack is of course the local knowledgable people like yourself, the cultures and Colombian business norms. We are well traveled but nothing beats feet on the street.

Thank you again for sharing your knowledge. I look forward to reading more of your blog. Have a great day.

Hi David,

I feel you – I would love to live in the countryside myself.

Doing business outside the cities in Latin America, usually means one thing: You have to be present. Nothing I can tell you will be able to get anything done for you on the ground here when it comes to operating in rural areas. The reason is that technology has (luckily) not reached those corners of the planet. The people don’t live glued to a smart phone. They don’t have websites. Their businesses are not listed in the yellow pages. It’s still very much the old way of doing business. You have to show up, shake hands, make connections and figure out who can help you.

You can be lucky to find some rural properties for rent on FincaRaiz.com.co but nothing beats having a local from the village help you out.

I don’t know what part of the country you’re looking to invest in? But, safety must be the first thing on your mind. There might be cheap land available in Cauca but if the narcos have their trails in your backyard then you’re in for a big headache. That is, if you make it out alive.

So, opt for safety first when choosing your region. Second, make sure you have access to water. Third, do soil tests before buying anything, if you plan to do any sort of agriculture. Do a title study with a lawyer who understands rural property lines and maybe even have the land measured with drone or digital equipment to make sure you’re not being promised something that turns out to belong to a neighbor. Many rural properties have not been measured in 50-100 years and the size could be off. Meet your neighbors before buying anything. Make sure they are good people and figure out if there has been dispute in the past. I could go on – you can reach out to me if you want to get on a call.

The good thing is that the trend is your friend, and right now people all over the world are looking to escape the big cities. Rural tourism is on the rise.

Hope this helps?

/Patrick