Here is what I wrote in bullet point 5 in my article on 9 Ways to Earn Dollars in Colombia:

“Buy an apartment, furnish and rent it out on AirBnB. All prices on their website are by default quoted in dollars. Bogotá, Cartagena, Medellín, Santa Marta, Taganga, Barranquilla and Cali all have plenty of demand. It could also be a farm house in the coffee district, especially Salento attracts a lot of tourists.”

Tourism in Colombia is picking up and has been rising every year for the past 10 years. News of the booming Colombian real estate market is also reaching far-away corners of the world. Both are great news for you as potential investor. And aside from a few neighborhoods in Bogotá and Cartagena, Colombian real estate is still very affordable by international standards. Paying less than US$1000/sq. meter for quality construction anywhere in the world is considered a bargain. In many big Colombian cities you can still find nice properties selling for less than US$500/sq. meter. That’s a bargain by any comparison and probably only seen better in Venezuela, Somalia, Congo, Syria and South Sudan at moment.

Investing in Colombian real estate and renting out your property gives you three ways to win:

- Positive cash flow

Renting out your unfurnished property in Colombia on a long-term contract (12 months is the norm) usually yields somewhere between 8-10% annually. Not bad at all. But by my own personal calculations, you can earn way more by renting the same property out short-term, especially if it’s a nicely furnished place in a great location. I’ll elaborate on this below. Never buy a property only as speculation. A property has to produce positive cash flow. - Rising property values

Colombian real estate is so cheap by all measurements, that even without foreign investors knocking on your door, I believe that annual increases in property values of 5-10% is very realistic. Industry magazine Metro Cuadrado seems to agree. The prosperity of the rising middle class will be the biggest force behind an increase in valuations. - A potential gain on currency

The Colombian peso is about as cheap as it can be, hitting its lowest level against the dollars of $3261 USD/COP a few weeks ago in late August 2015. It has reached the point of maximum pessimism. While it may not begin rising tomorrow, I do believe that over the long-term it will return to its historical average somewhere between $1800-2000. That’s a potential 30% gain if you are investing USD, EUR, JPY or GBP – a massive profit for a currency speculation.

I list the best places to find properties for sale in Colombia on my resource page.

AirBnB

If you don’t already know what AirBnB is, let me tell you quickly. It’s an online platform where regular people like you and me can rent out furnished houses, apartments or rooms short-term to business people, tourists or locals. It makes it more affordable to own a holiday home if you can generate income with the place when you’re not using it. While it does require a little more work, the short-term rental market also allows for higher daily rates than if you were renting out by the month. Many people, including CEO’s of big companies, are actually beginning to prefer staying in private residences as it provides a warmer, more cosy and personal experience than staying in hotels all the time.

A powerful feature on AirBnB is that the property owner reviews the clients after the stay and vice versa. It creates the margin of trust necessary for renting out your property to a stranger. Renting out your place on AirBnB also comes with a $1.000.000 USD Host Guarantee, free of charge, for all eligible bookings. Unfortunately Colombia is not yet covered by this guarantee, but AirBnB claims that they are working to implement it for all of its remaining markets.

But really, you don’t have to use AirBnB for renting out your place. It’s just an easy way to reach a large audience. You could market your property through your own website or list it with a full-service property manager like The Apartment Medellín.

If you’re in Cali, I’d be happy to help you buy and manage your property as well.

Tips for improving your occupancy on AirBnB

Renting out your property on AirBnB means that you will be in direct competition with the local hotels and other local property owners listed on the platform. While you may not have a big marketing budget, there are things that you can do to improve your occupancy. When people choose to stay at a private house versus a hotel, it is usually because they are looking for a more personal experience than the standard hotel room offers. This is very important to remember, because personalizing the experience for your guests does not have to cost very much.

The natural instinct of most people is to rent a nice place, well-decorated, in a good location and at a fair price. In addition, most people base their decision on the reviews that the property has received. The reviews are a result of the overall impression of the property as well as a reflexion of you – the host.

Here’s a list of small things you can do to boost your positive reviews and occupancy:

- Take good pictures and have a great description of your place. Include a floor plan if possible and even a photo of a wifi speed test. Tourists and business people alike LOVE powerful wifi.

- Keep you place spotless clean, with clean towels and bed sheets.

- Have clean, fluffy bathrobes for your guests to use.

- Have a universal charging dock.

- Make your place feel like a home and not just a cheap rental for tourists. This does not have to be expensive to do. It has more to do with the little details. I’m sure you know the feeling when you step into a good friend’s house – that’s the feeling you want to emulate. If this is beyond your capability, ask a female or gay friend to help you decorate.

- Write a short welcome letter which includes your contact details, a note about local transportation, and list your favorite 10 things to do in the city. If in Cali, leave a link for the CaliAdventurer blog for inspiration. If in Medellín, add MedellínLiving, and so forth.

- Get or make a small map of the city to help your guests navigate. Add a few neigborhood recommendations like a restaurant, a hair dresser, a supermarket, a bar, etc. You can get maps from the local hotels or tourist office.

- Include a few complimentary items as a pleasant surprise to a weary traveler: Coffee, a few beers, sodas, water, chocolates, fruits and maybe some breakfast cereal. Like a mini-bar – just without the boring the bill that comes with it.

- Price your place for the seasons – use Booking to see how the hotels are doing it.

- Keep your AirBnB calendar updated and be quick to reply. Getting the app for your smartphone makes this easy.

- Don’t be afraid to set some limits. Minimum stays, check-in times and house rules make your rental manageable and you a better host.

- And finally, don’t forget to smile, be responsive and offer kick-ass service!

Here’s what I am in the process of doing myself

Colombia is in my opinion a cash buyer’s market. Financing through a Colombian bank and paying 10-12% annual interest is very unattractive from a foreigner’s perspective. It’s also going to eat away most of your profit.

After I lost $100.000 dollars on a property transaction, I was left with little cash left to do any investing. Even though I got scammed and my initial reaction should have been to stay far away from the Colombian real estate market, I just couldn’t. I keep seeing opportunity wherever I go. I began looking at smaller projects that could produce positive cash flow from day one. So far I’ve found 3 places that I am in the middle of negotiating. The problem is that I only have cash to pay for one apartment.

Time to get creative!

I contacted my Danish bank and asked them for credit. When I told them that it was for Colombian real estate, their natural response was to reject my proposal as they couldn’t get any collateral. The other reason they rejected my proposal, was that they thought I needed a lot more money than I actually do. A decent apartment in a big city in Denmark easily cost $500.000 dollars and there is no way they would loan that kind money to someone without the ability of having any collateral.

When I proposed a $100.000 dollar loan – enough to buy two apartments in Cali, they became more willing to negotiate. Interest rates for collateralized real estate in Denmark hoover around 2% annually for a 30-year mortgage. I aimed for a 5% non-collateralized loan, but in the end I settled for 6% which was the lowest I could negotiate with my bank. Still a bargain by Colombian standards.

A hundred thousand dollars equal about $300 million pesos by today’s exchange rate. That’s enough to buy two nice little apartments in Cali and get my business started.

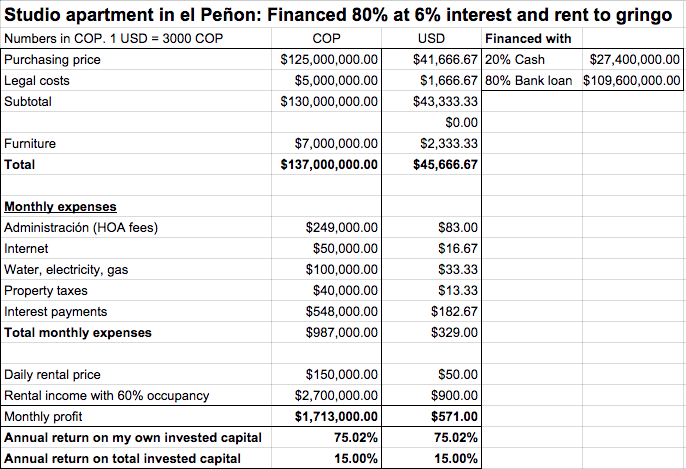

Here’s a budget I’ve made for a studio apartment, that I’ve found in barrio El Peñon – an attractive and safe neighborhood in Cali’s gastronomic district:

The interesting part is, that if I choose to pay everything in cash, I will earn a 15% return on my cash investment. That’s OK. But by financing 80% through my Danish bank, I’m capable of earning up 75% return on my own capital investment – the only number that really matters. Even if I lowered my daily rental price to $40 and set the occupancy to 50%, I’d still be able to generate 35% on my original cash investment.

With this kind of profit, there will be plenty of capital to pay off the loan and cover unforeseen expenses, which will probably be few, as the building in question is only 8 years old.

Tell me where else in the world that you can make such a great real estate investment at the moment? Especially when you factor in the cash-flow, the weak peso and the rising property prices. Even if the exchange rate stays the same, I should be able to pay off my loan in just over 5 years.

It’s also a win-win for the guest. Paying $50 a night for an apartment in this part of town is cheaper than staying at the hotels in the same area.

What if you have no money to invest?

As I’ve showed above, you don’t need huge amounts of capital to make this idea work. But if you don’t have a bank willing to loan you any money, I still have an idea that I have seen work for one of my friends in Cali.

My friend has signed long-term leases on several apartments in good locations. He decorates them nicely and rent them out short-term to foreigners. What he earns is the difference between his lease and the amount of money he is able to generate with his short-term rentals. All he needs to recoup is his investment in the furniture.

The most important thing in this scenario, is that your landlord is OK with the idea of you subletting his property. You could offer to pay a little more and promise him that you will take good care of his property. Make sure to only do this with properties in areas where you know that there will be a demand.

If you don’t believe in this option either, you could start by renting out a room in the apartment or house where you currently live. It will not give you the same earning potential, but will still be a way to earn some dollars and help pay the rent.

Anyone pondering the same ideas? Any questions? I’d love to hear from you in the comments below!

While I agree with your statement that renting short-term is very attractive in Colombia it’s important to note that renting for less than 30 days is not legal without a valid hotel license. If the Ministry of Tourism (that’s the authority in charge for these cases as far as I’m aware) gets wind of what you’re doing you can get a fine that will eat up all your earnings.

Also, the $1.000.000 USD Host Guarantee from Airbnb does NOT cover Colombia as you can see here: https://www.airbnb.com/guarantee.

Dear all, the article is interesting but not realistic. Unfurnished with all taxes, administration fee and so on. might be lucky with 4 percent. Furnished is extremely timeconsuming. Your list of what people supposed to find, you must do yourself. Colombians cleaners do their work as it looks like they lived in caves. Got fot three years rentals and drives me mad and still not msaking money after all me investments. especially buying furniture, new kitchens, bathrooms etc. the maintenance is three times higher as normal living

Hi Daniel – thank you for bringing this to my attention. I had not seen this map before. I was fine-reading the terms where it does not mention this. I’ve updated to article to avoid confusion.

– Patrick

Hi Daniel,

While this may be correct (I’m in the process of finding the law), I’m pretty sure that it makes 99% of all the rentals on AirBnB in Colombia illegal. It seems like a law that as been passed by lobby from local hotels to keep competition unfair.

Even if you don’t rent out by the day, you can still make a decent ROI by renting month-to-month. In Cali, foreigners pay between $1.7 – 2.0 million pesos for a nice studio per month. Enough to still generate 35% ROI on your own invested capital, if you are able to finance with 6% like I am.

– Patrick

Hi Jan,

Sorry to hear about your bad experiences. Much to my surprise, it sounds like the Medellín market might have become saturated with all of the foreign and local investment pouring in.

In Cali you couldn’t sell a property that generated only 4% annual return. Most landlords aim for 1% a month (12% annually) and the real estate is priced accordingly. A funny thing is, that the more expensive you buy, the harder it will be to recoup your investment – especially if you are renting to locals. Here, estrato 1-4 yield 12% annually, while many properties in the higher estratos yield around 8%.

BTW. I’m very happy with my cleaner.. maybe it’s because I don’t treat her like a cave woman

– Patrick

Patrick- Great article. Thanks for sharing your insight. One question: I dont see in your financial analysis the monthly mortgage loan payment to your bank in Denmark. Did I miss something? That would be several hundred dollars a month or so, yeah?

Thanks!

Ryan

Hi Ryan,

Thanks for reading and commenting.

In my budget, I’ve only added the interest payments, which is the actual expense. How much one chooses to reduce his / her mortgage with every month is an individual decision. In my case, I have chosen to pay the mortgage back in 5 years. I consider it my long term savings.

Saludos, Patrick

Patrick,

Now I got it. Thats great your bank at home gave you a loan. I am going to look for a bank here the states that will do the same, fingers crossed, but I have never heard of any bank doing it. How have the Airbnb rentals been going? Im looking into buying something in Medellin. Fell in love with it when I was there last month.

Take care

Ryan

I will be finishing my first unit this month – excited to see how it will go!

Medellín is also a cool place, but you will be paying a premium per m2 compared to Cali.

What about Colombian income taxes?

I think you are overly opportunistic with your 8 % – 10 % rental yields.

You would be lucky to get over 5% in Cartagena at least in the estrato 5 / 6 barrios.

I had a place in the old city of Cartagena that I rented on Air BnB a couple of years ago.

Never got anything near 60% occupancy. Though to be frank I never really put any effort into it.

I would also advertise in every possible short term rental website and put your apartment on this blog, http://www.fincaraiz.com.co, http://www.trovit.com.co, basically every where you can think off.

Good luck with your business. I hope you all the success.

Nicolas, I’ll let you know how it goes in a few months when I have some more complete numbers.

In Cartagena, I was staying in a 3 bedroom apartment in the old city in November, 2015. He said it was always full (about 80% occupancy) and we paid $250 dollars per night. The owner was happy as a clam.

You also have to remember that Cartagena has the most expensive m2 in the entire country, plus a huge supply of hotels, hostels and rentals, which explains the lower yield.

Regarding the taxes, everybody’s situation is different, so you’d have to see you accountant about that. I’d advise to deduct as many expenses as much as possible. Also, the first $37 million pesos are tax-free.

Love your post,

I have been contemplating the idea of investing in Cali. I know that most of your comments and numbers are very accurate. I have done myself a deep analysis of the market and I know you are certain of what you are talking about.

My questions to you are:

How is your Airbnb going, in terms of numbers such as revenues, expenses and profits?

What is you Airbnb rate of occupancy?

How much is a fair competitive rental price?

How difficult is to manage the operation?

If you have some extra tips I would appreciate them.

As a personal comment, I’ve been in Denmark and I love it,Copenhagen is one of my favorites cities in the world. To bad is quite expensive. Nevertheless, Denmark and Danish people are awesome.

Ok Patrick, let’s keep in contact and I hope hearing from you soon.

Thanks,

Regards,

Juan Carlo

Juan Carlo – thanks for commenting!

My AirBnB business begins next week – my first clients are arriving from France and will be paying $3 million pesos for one month in my completely remodeled 2-bedroom apartment in Peñon. For that reason, I can’t tell you anything about occupancy, operation management, etc. yet. But in a few months, I will have more information to share. I’m also in the process of starting a real estate agency for foreigners wanting to invest in Cali. One of our services will be property management, allowing investors from all over the world to invest in Cali real estate without having to be present. Soon I’ll have more details.

Glad you had a great time in Denmark. I totally agree that Copenhagen is among the coolest cities in the world. I love my country and try to go back every year… but ouch – it hurts earning pesos and traveling at the moment. Just one more reason for earning dollars if possible

Saludos, Patrick

Patrick, how much is income tax on earnings from property rent in Colombia?

Patrick, any chance I could have a personal word with you one day?

I have had many of the same thoughts as you on this and I am currently living in Medellin.

Og saa er jeg forresten ogsaa fra Danmark.

Mvh

Andres

PM sent!

The first $37 million in income here are tax-free according to my accountant.

After that, everyone situation is different, but it could be around 19-22%.

Hope this helps? Patrick

Hello Patrick, love the blog! Please make more posts

I sent you a message through the contact section on the site but not sure if you got my message.

PM sent!

Hi Patrick, I’ve been watching this post for months, waiting for more info once you get it! My husband and I were considering doing Airbnb in Santa Marta, but I can’t find the regulations for short term rentals anywhere. You mentioned you might go into property management in Cali, so I was wondering if you had found out about it. is there is one rule for all of Colombia, or if it a city by city thing (I imagine enforcement would vary quite a lot.) I’ve heard from people doing Airbnb in Medellin that you must have a hotel license for rentals of less than 30 days. Thanks and Love your blog!

Thanks for this really interesting information. I’m checking now the opportunity to by real estate in Colombia but i’m confused when it refers to taxes for non residents. Can you please tell us about taxes paid for non residents of colombia. Internet has conflicting information and it is crucial for this article to be complete

Also please tell us if there are more (or less) taxes to be paid for airbnb use in copmarision to normal rent

Thanks!!!

Inanna,

With First American Realty we are opening a property management division here in Cali.

Here’s what I know…

If you want to do short-term rentals (less than 30 days), then 70% of the owners in the building has to agree to it. This is hard. Especially in Colombia where trust is low, and people hate the idea of having strangers in their building. For that reason, the best way to circumnavigate this law is by owning the entire building in which case you can do whatever you want. This is exactly what we do with our PREPs which you can read about in this article.

In my own apartment, I try to do only monthly rentals, unless I’m renting to friends/family, in which case I explain the administrator that the people in the apartment were invited by me.

In the scenario that you own the entire building, you should get a “uso de suelo” from the local government as either hostal, apartahotel, hotel, otro tipo de alojamineto, etc. There are many categories and some less administration and amenities than others. In this case, it’s like owning a business, registering it with the local chamber of commerce, and so forth.

Hope this helps…

/Patrick

Yoav,

If you are serious about this, then I suggest that you contact a local accountant to help you. I can not give tax advice. First of, I’m not and accountant and secondly, everybody’s situation is different.

What I have heard that my help you is this:

If you are a resident of Colombia, then the first $37 million pesos that you earn are tax-free. After this, your tax rate is 19%.

If you are a non-resident, then, in theory, you should be paying 34% on all income if you can’t find any deductions like maintenance, etc.

But with Airbnb you can choose how to receive the money. You can rent out your apartment in Colombia but receive the funds on a bank account in Panama and in theory be tax-free as Panama does not tax income earned abroad (if I remember correctly). It will be very hard for the Colombian authorities to control this. Then again… I’m not suggesting anything that might be against the law…

Patrick, would love to hear how your experience in Airbnb is going! I’m considering listing a place in Bogota on Airbnb and while I know it’s a completely different market from Cali – I think it would be very helpful to hear from you.

Thanks!

Hey there Patrick,

I’m jumping on Santiago’s question and curious to know how your AirBNB xperience is going. I’m heading in Cali in a few months and am thinking of possibly renting out my Cali apt for short term rental on AIRBNB. I’ve used them in the past and enjoy their service… Any feedback would be highly appreciated.

Con aprecio!

Andrea in the Bay Area, CA

Hi Andrea,

Santiago also sent me an email where I answered – must have forgotten to update the answer here.

Anyway, I advertised the apartment on the blog and on Airbnb – http://caliadventurer.com/apartment-for-rent-in-cali/

The post includes the dates that the unit has been booked. The occupancy has been around 75% since May of this year. Some clients have arrived through Airbnb, some through the blog and some by word of mouth. All in all, I’m very satisfied. I could probably have a higher occupancy if I allowed shorter rentals. In order to keep the building administration and neighbors happy, I try to do minimum 1-month contracts. It also ensures that I comply with local regulation.

My partners and I are developing 3 buildings with units for short-term rentals and we will also begin to administrate apartments for third parties. So if you need help managing your property in Cali then please shoot me an email at patrick@caliadventurer.com

Ciao, Patrick

Hi Patrick, very interesting blog. I would love to learn more about your experiences since your last update. Will PM you. Cheers, Joachim

Your email with all the questions has been replied, but because it may be relavant to others, I’m sharing below:

Joachim: What was the process to draft a loan from a Danish bank for this project?

Patrick: It was literally 3 emails and a digital signature. $100.000 dollars is very little money in Denmark, so I just got a 5-year working line of credit at 6%.

Joachim: I was surprised that a bank is financing 80% of a real estate project in Colombia. What were the criteria here?

Patrick: Same as above. If you have a hard time getting the credit then offer to put your own house as collateral (if you have one). In this case, I could have gotten 2% interest for 30 years.

Joachim: Why did you not take a loan in Colombia? I read in Colombia the interest rates for real estate loans are much higher than in Europe? Was that the reason?

Patrick: Yes, the best clients in Colombia can get 10-12% interest rates. My neighbor pays 19% on his house. It is ridiculous and makes no sense for real estate investing.

Joachim: Would you be able to give me some more insights about the economic results of your projects, basically an updated calculation from your blog with the actual real numbers, how you experience them? Really interesting would be the auxiliary costs (ongoing taxes, internet access, etc.)

Patrick: I’ve been generating about 12% ROI with 76% occupancy. This is after paying all of my property taxes, internet access, etc. This is the bottom line with me managing my own units. With someone else managing for you, expect 8-11%.

Joachim: In your last post dated Nov 2, 2016 you mentioned that you are currently developing three buildings incl. an administration approach. Really interesting, I hope this is going well since then. Can you tell me more about how this is going?

Patrick: It is going really well. We started renovations 3 weeks ago on the first project, Villa del Peñon. We just got the license to remodel Granada Executive Suites and should begin within a couple of weeks. The last project, Brisas del Peñon will begin in mid to late February.

Joachim: Is this going to be a similar service approach like American Realty PREP etc.?

Patrick: I am the Cali partner of First American Realty, so yes – that is exactly what we do!

Joachim: I was reading about First American Realty and proposition. How do you rate their services? Do you know someone who invested through FAR in Colombia? Do you fund such projects yourself or do you raise investments from other parties?

Patrick: Since I’m a partner, of course, I am biased, but the reality is that we have more than 200 happy investors in our projects. The model works, and we have never missed a payment to the investors. But the truth is that even my own mom has invested in our projects.

Joachim: How would you rate the potential for the housing / rental market between the different major cities in Colombia?

What do you observe and where would you invest next?

Patrick: Cali is the cheapest and up and coming for Colombia. Obviously, there are more tourists in Cartagena, Bogota and Medellin, but you should also expect to pay 2-10x more per m2. Cali tourism is growing at 19-20% per year, so I believe that there’s a very bright future here – especially for the short-term rentals that we specialize in.

Joachim: In order to achieve the best possible ROI with a short-term rental strategy, which type of property would you think is best in terms of

– size (number of bedrooms, qm).

Patrick: We have a mix of studios, 1-bed, 2-bed and 3-bed units. They all rent and we have good occupancies across them all, to be honest.

Joachim: Standard of flat and furniture (luxury vs basic)

Patrick: We develop nice units to compete with 4-5 star hotels. There are too many hostels competing for cheap backpackers.

Joachim: Since beginning my research on short-term rental platforms such as Airbnb I’ve gotten a very differentiated picture. It would be great if you can share some experience about expected occupation for luxury vs basic flats.

Patrick: I don’t have a differentiated number in my head. We had 76% across all units in 2016 in Cali. Hope this help!

PM sent

Great post, thanks Patrick!

One thing I am trying to find some clarity on is how the 30 day minimum short term rental applies to houses? I am considering buying a house in Medellin and would primarily rent it AirBnB for 5-7 day rentals.

I have heard conflicting advice from brokers there and can’t seem to get a straight answer.

Any help would be appreciated!

Bo – great question. You can do short-term rentals if you own the entire house. But you will have to get the RNT – Registro Nacional de Turismo and comply with the NTS002 – Norma de Autosostenibilidad.

You can get the RNT at the Chamber of Commerce but will probably have to hire an advisor to help you with the NTS002 as there are 90+ bullet points to comply with.

Hi Patrick, thanks for the great post!

Currently we’re looking into subletting houses. However, realtors are very difficult in finding good real estate that can be sublet. Any ideas on this?

Is it only permission you need from the owner, or is it also for them a struggle to make subletting of their property legally allowed?

Love to hear your thoughts on this

Hi Patrick, It would be interesting to see a 2018 update of this answer, as it is really complete

Quick question: does FAR accept investments from Colombians? or only foreigners?

Hi Sebastian,

I’d love to give a real comprehensive update, but the reality is that the government with Migracion, RNT and Tourism Police is making it hard (illegal) to run furnished short-term rentals with contracts shorter than 30-days, unless you own the majority of the building and can change the “reglamento de propiedad horizontal”. I’m selling my individual units now and only focusing on the entire buildings we are developing with FAR and where we can comply with all the regulations. It was fun and profitable while it lasted, though

And YES – Colombians can invest with FAR – minimum investment is $25.000 USD. I’ll reach out to you with an email.

Best, Patrick

I think you only need permission from the owner, but maybe from the Home Owners Association as well. Not sure. Check with a lawyer.