Back in 2015 – after getting scammed in a real estate transaction – I wrote a post on how to buy real estate in Colombia. Since then, several readers have reached out to me asking for help on how to SELL their property in Colombia.

After 6 years of living here and working mainly with real estate, I feel like I have gathered enough experience from the transactions that I have participated in, that I can share some very useful information and tips for future property sellers.

Realtors / Agents / Intermediaries

The first thing to be aware of is that you don’t need a realtor to represent you during a sale. In Cali alone, there are several hundred real estate agencies, but the hard truth is that most of them are worthless. Let me explain why…

In Colombia, being a realtor is not a protected title nor an accredited profession from a university. Anyone can call themselves a real estate agent… and that obviously attracts a lot of people to the industry who unfortunately have no clue what they are doing, but who are just trying to earn a quick commission.

It is common practice for those “realtors” to simply snap a few (poor) pics with a cell phone, write a basic description and upload the ad to a MLS, do a showing and hope they make a sale.

I’ve been to countless property showings with these kinds of sales people who have not even prepared the most basic information about a property before meeting you…

How much is the annual property tax? What estrato is this? Is there a mortgage or any liens held against this house? Does the apartment complex have an electric back-up generator? How much are the HOA fees per month? Do you have a list of permitted activities for this lot?

The answer is usually something along the lines of “Oh, I don’t know, sorry, let me ask the owner”.

The reality is that these people are more like informal intermediaries who know the owner. They know that he or she is looking to sell. And they have made an arrangement where they will earn a commission if they INTRODUCE seller to a buyer. And many times there will be 2-3 intermediaries (friends of friends who have made introductions) trying to get a piece of that commission in the same transaction, making things even more complicated. It is culture and just the way things work in Colombia. But don’t expect this kind of agent to hold your hand through a transaction or help you resolve any doubts. They are working first and foremost to earn themselves a coin.

Most big cities have a local association of realtors – known as the La Lonja de Propiedad Raíz which does allow members to sign up for courses on real estate transactions. The Cali association can be found here. The agencies who belong to the Lonja are usually more serious and well-versed in the ins and outs of how do buy and sell property. So IF you plan to use an agent, I highly recommend that you use someone that is affiliated with the association.

Also, remember that most agents or intermediaries in Colombia do not have any exclusivity to their listings. For that reason, you will often see signs of several agencies in the windows of properties for sale. And the lucky one that receives a call from a buyer earns the commission. The good thing being a seller is that you can allow several people or agents to represent you at the same time if you feel like the one you have is not doing a good job.

As a sidenote, when I’m looking to buy a property and I see 3 different numbers in the window – two nice “professional” for-sale signs and one hand-written one – I always try to call the hand-written sign… and if lucky, I’ll end up directly with the owner which in my experience makes the negotiation a lot easier.

The standard rate as far as commissions go is 3% of the sales price. The serious agents as well as your neighbor who referred you a buyer will expect to earn the same 3%. If there are more intermediaries involved (friends of friends), then they will split the commission. Like anything else, this commission can be negotiated as well, but do it beforehand and not once the buyer is in front of you.

If choosing to work with an agent, then make sure to put your agreement in writing to avoid any confusion. It can be a simple paper stating that you allow X person the non-exclusive privilege of helping you with the sale of Y property for the next 6 months, thus earning him or her a Z commission in the event of finding a buyer. I would also ask them how they plan to promote the sale. If all they are doing is listing it on the MLS, then there’s no real benefit as you can do that easily yourself. But, some agents have a broadcasting list on Whatsapp where they share listings with other realtors increasing the odds of selling quickly. The very best agents even have a database with potential buyers lined up for specific properties.

Once the buyer has been found, I would add the payment of the commission to the promesa (sales contract) and have the buyer deduct the commission from the sales price so that the agent earns his or her check the same day as you sign titles at the notary and you receive payment for your property. This way you avoid paying the 4×1000 tax on the money that goes to the intermediary.

Bottom line – the main reasons you should use an agent or intermediary to help you sell a property in Colombia is if you are not present in the city yourself or if you simply do not have the time or patience to deal with it. That being said, I do want to offer one final word of caution:

This is Colombia and there is a lot of “funny money” in circulation: Money that come from money laundering, drug dealing, illegal mining, etc. Having a legit agent can help you filter many of the potential criminals that may be interested in the buying your property. Although some people may be desperate to sell and think that all money is created equal, it’s better not to deal with these types of people. In general, Colombian property and land owners pride themselves of the title history – la tradición – to demonstrate that their property has never been affected by dirty money.

How to value your property

Most likely, you already have a gut feeling for the value of your property.

The exceptions might be if have inherited a property or have owned it for a long time without ever looking at how the prices in your local market have developed.

If working with a good local agent, he or she will most likely have an idea about how much your property is worth. That being said, I’d recommend that you do your own due diligence as well.

If you don’t have an agent to help you with the sale of your property you will have to do some homework on your own to determine how much to ask.

There is, of course, a big difference in determining the value of your property when selling an apartment, a commercial property, a mango plantation or a cattle farm. For simplicity, let’s focus on urban properties in this post.

Here are some ideas that come to mind:

- Reach out to the local realtor association and hire one of their experts to make a professional appraisal. It’s called an avalúo. The Cali association offers the service here. While I have never gone this route, it should cost about $500.000 depending on the value of the property. I have purchased below the value of a professional appraisal, but it does give seller substantial negotiating power.

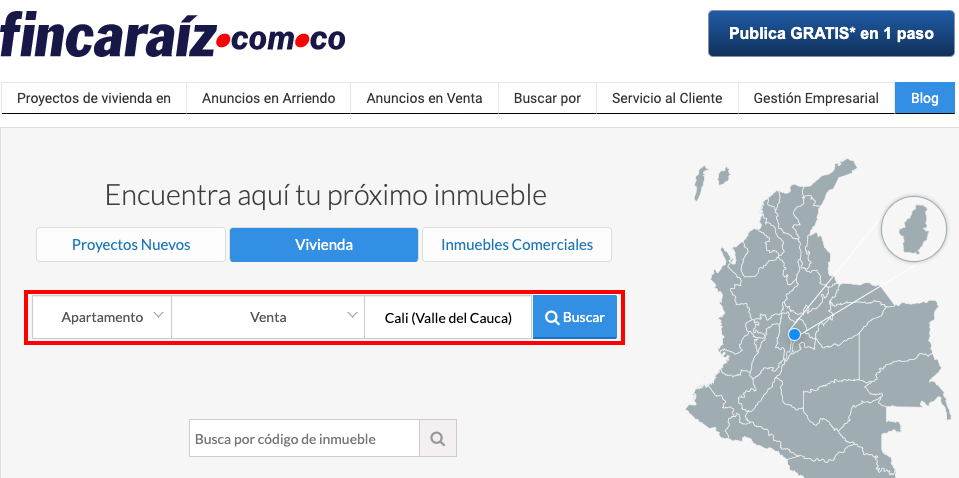

- Sellers in Colombia do not focus much on potential revenue generation in the event of renting the property in the future. So selling at a cap rate is sort of an unknown concept here. Maybe because the return is usually so low (4-8%) that it would not cover the cost of interest payments to the bank. Prices are usually calculated per m2 and based on comparison to what is currently on the market. So a good place to begin is by researching prices per m2 in your neighborhood. The easiest place to do that for the big cities in Colombia is via the MLS called FincaRaiz. Choose apartments/house for sale in Cali. It looks like this:

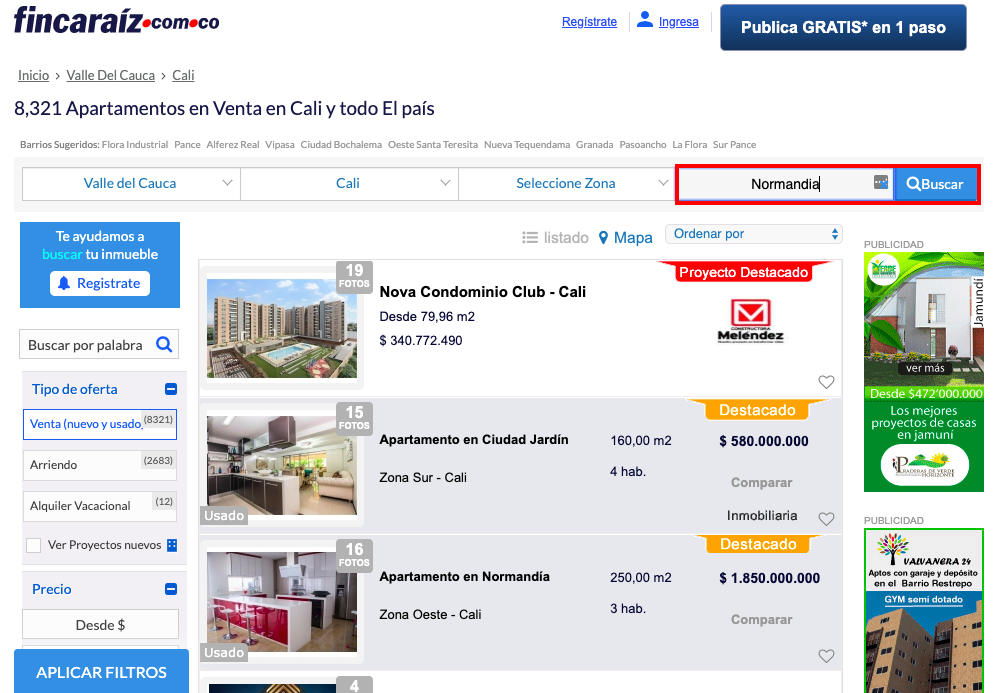

Then filter by typing the name of the neighborhood where your apartment is located (in red box).

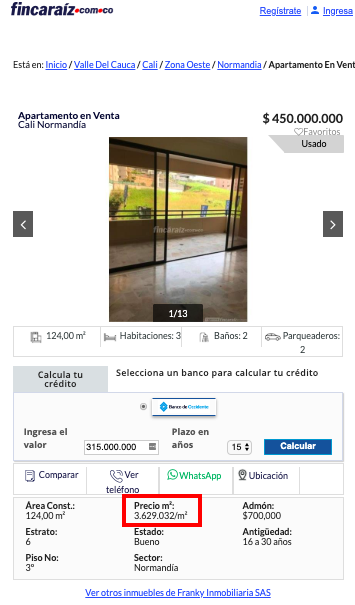

Once you have it narrowed down to the to your neighborhood, you can begin adding filters in the lower left side of the site, such as amenities, size, bedrooms, etc. Now, that you have a list of properties located in the same neighborhood and with many of the same features, you can begin clicking on the individual listings which will pop up like this:

The red box shows the asking price per m2. Then begin to compare the condition of the unit, if it needs to be renovated, what the common areas look like and if there are any other discounts that you may need to take into account. It’s important to note for apartments, that if they don’t have an elevator, then that will always result in a lower price per m2. I would make a spreadsheet and list at least 10 units to use for comparison.

Colombians who can afford it like to buy new homes and will pay a premium to do so. In Cali there’s a tremendous amount of new constructions projects on offer. I would almost say an over-supply at the current state in certain parts of the city. Most of them are located in the south, though, while most of the jobs are in the city center or north. This results in long daily commutes which eventually will wear people out.

In other parts of the city you will find neighborhoods where there is no more land to develop… Where there are few or no new developments. If you combine this with an area with lots of employment, then you will most likely find that there’s a housing shortage and scarcity can be a great force to help appreciation of your property.

What is an attractive neighborhood is of course subjective. But I think something that most people can agree on are areas that are safe, close to employment, with good infrastructure, public transportation, schools and so forth nearby.

If you are still clueless as to how much to ask, then understand this:

Property prices have gone up an average 8% per year over the past 10 years in Colombia. So if you purchased 5 years ago, try adding an 8% compound appreciation to your property for those years and see where what price you will arrive at.

Also, when determining your price, remember that Colombians love to negotiate. It’s part of their culture. So don’t put your final price in any listing. Leave some wiggle room and be prepared to come down 5-15%.

Credit is expensive and access to credit can be complicated. I see this as the number one reason that real estate in Colombia is still very affordable in most parts, at least by international standards (and the current strength of the US dollar, of course). But it also means that the market is not as liquid as sellers could hope for. I see many properties sitting on the market for years without being sold. So arm yourself with some patience if you are planning to sell, unless you are fortunate enough to own property in an area with little supply or have it priced to sell fast.

Luckily interest rates are slowly coming down and more people are beginning to get access to loans which will hopefully add more liquidity in the near future.

How to market your property

The best nationwide multiple listing service (MLS) in Colombia in my opinion is FincaRaiz, but there are others such as OLX and Metro Cuadrado as well.

On top that, each big city usually has a newspaper with a local classified’s section. The one for Cali is on the El País website.

First, have some really good pictures taken. Most sellers and agents avoid this step in Colombia but I feel like it is super important to have your property show well. You can get a professional photographer to come and take pics for $200-400.000 depending on the size and quantity.

Second, I suggest you add a listing to both FincaRaíz and the local classifieds. Basic listings are free on FincaRaiz but I think it makes sense to pay for an upgrade to have your listing moved to the top of the search results. Add a great description. Don’t bother with the physical print section.

Third, if your property is located in a building or gated community with a front desk or guard, then let them know that you are looking to sell and offer them a commission for referrals.

Fourth, share your listing with friends, neighbors and contacts via Whatsapp and social media (and potentially offer incentives to have them help sell). A neighbor might have friends or family that are looking to buy.

Fifth, make a folder with copies of all the documents necessary for a buyer to do due diligence, request a loan from the bank and perform a title study. They include a copy of your title, property tax, title history, a utility bill, etc.

Finally, don’t be surprised if realtors contact you saying that they have a buyer. They have obviously seen your listing and would like to represent you. If they have a serious lead then it would be foolish to reject it.

The technicalities of closing on your property

The promsa – sales contract

Once you have found your buyer and you have agreed to the price and terms of the deal, it’s time to put a sales contract in writing called the promesa. Usually, the buyer will have an attorney perform a title study which is common practice and the easiest thing is to use the same lawyer to draft the promesa. If this is your first time ever entering such an agreement, then I suggest that you hire your own attorney who specializes in real estate transactions to help you out with a review of this contract. If you need help in Cali, then I have a few that I can refer you to. A review of the contract and any other documents should not cost more than $300.000. If you need help with the elaboration of the contract itself, then expect to at least double that amount.

Here are some general clauses that you should make sure to include in no specific order:

- Names, ID and roles of all the people, buyers and sellers, who are involved in the transaction.

- Date and place (notary) of signing the contract and of signing the new title (escritura). Usually those are two separate dates as buyer will need to have this contract signed in order to get a loan from the bank, etc.

- Description, location, size, public title numbers of the property being sold.

- A description of all liens, mortgages or other debts that are held against the property (if any), and how seller plans to have them removed from the title.

- Total sales price of the property, initial down payment to lock in the deal, and the form of payment for the remaining amount due to all the sellers. The down payment is agreed between the parties and range from 1-20% of the purchase price depending on your negotiation.

- Date of delivery of the property to the buyers and in what condition the delivery is expected. For instance, freshly painted, furnished, with electrical appliances, etc.

- If buyer is allowed to access to property before closing for architectural or zoning purposes.

- Prorating of property taxes and what date buyer will begin assuming the payment of the utility bills.

- How to split to closing costs of the property. The common practice is:

- “Retencion en la fuente” – 100% seller. This is a 1% tax of the sales price that goes to the government.

- Notary costs – split 50-50 between buyer and seller.

- “Boleta fiscal y registro” – 100% buyer. These are the taxes that buyer pays to the government in order to be able to register the transfer of ownership at the title office.

- Who will pay commissions to any intermediaries or agents involved in the transaction. Usually the seller pays 100% of any commission, but it depends on the negotiation of the particular deal.

- Deciding on a legal jurisdiction in the event of a conflict between the parties.

- Etc

In essence, add anything you can think of that might be the cause of a future misunderstanding. Better safe than sorry.

Most importantly, remember to stick to your part of the deal and comply with your responsibilities.

Escrituras – signing titles

Before the big day arrives where you will be signing titles and transferring ownership of your property to the buyer, you will need to prepare a bunch of documents and take them to the agreed upon notary a few days in advance so they have time to prepare the draft (minuta or borrador) for the new title (escritura). The lawyer that prepared the promesa can also perform this task but is usually comes at an extra cost whereas the notary will do it for “free”, meaning that it is already included in the fees they charge to handle the transaction.

If you can manage to convince the buyers to do the transaction at the same notary where you originally purchased the property, then the whole process will be smoother.

In either case, any notary will do. Just makes sure that it is was agreed to by both parties in the promesa.

Inside the notary, ask for the department that handles “escrituración” – elaboration of new titles.

This is the list of documents that they will need in order to prepare the new title:

- Copies of IDs of all parties involved in the transaction.

- Your current title (escritura) for the property and if they have any doubts about certain details in the history, they may ask for previous titles as well. If you have lost the originals, then you can get a copy from the notary where you signed titles when purchasing the property. If you forgot where that is, then look at the title history.

- A recent title history (certificado de tradición), preferably printed maximum a few days in advance. You can buy and print them from the website of the Superintendencia de Notariado y Registro.

- A copy of your latest property tax (Recibo de impuesto predial). For Cali, you can download is here if it didn’t show up in your physical mail.

- Paz y salvo Impuesto Predial – this document certifies that you are up to date with your payments of property tax. You can download the certificate here for Cali.

- Paz y salvo Valorización – also known as Megaobras. This was an extra one-time tax that was levied upon all property in Cali during the previous Ospina administration in order to fund several large public infrastructure projects around the city. Medellin did something similar. This document certifies that you have completed your payments of this special tax. For Cali, you can download it here.

- Paz y salvo de administración – if you live in a building or condominium, the administrator should give you a certificate that you are up to date with your payments to the home owners association. If not, you can not sell.

- Original power of attorneys signed at a Colombian notary, consulate or embassy if one of the sellers will not be present at the signing.

- If one of the sellers is a minor, for instance via inheritance, you will need to get a professional appraisal done which needs to be approved along with the promesa by a family court. This is to avoid the scamming of minors by family members trying to sell off their assets for their own gain. Sad but true, it does happen. If this is the case, then I suggest that you look up the nearest “Juzgado de Familia” and ask for the procedure. Don’t leave this task for last minute.

- Estampillas – tax stamps. You can buy them at the local Gobernación in person or online. But the reality is that the website for the Valle del Cauca state is complicated and it’s a lot easier just to buy them at the plaza in front of the mayor’s office (CAM). The Cali CAM is located here. There will be vendors all over the plaza screaming “¡estampillas!” so it should not be hard. Tell the vendor that it’s for a property sale and they will know which ones to give you. They should cost less than $20.000 COP.

At the notary, please do yourself a favor to proofread the draft of the new title very well and double check all ID / property numbers. It’s a hassle to get it corrected later.

After signing, having your fingerprint taken and paying the notary for its services, all you to do is collect payment and hand over the keys to the property (if agreed to at this stage in the promesa).

The new title needs be signed by the notary public which can take a few days, before it can be taken to the title office, known as “Oficina Registro de Instrumentos Publicos” to be registered. The notary usually offers to do this for you which I highly recommend that the buyer accepts. I once tried to do it myself and it took 6 hours standing in line at the title office for them to receive my documents plus 15 days to actually get the title transfer registered in their system. But, as a seller, if you have received payment, I would not worry too much about this step as I guarantee you that the buyer will be on top of this.

That should be it. In Colombia there is no escrow nor title insurance involved meaning that there are no more steps involved.

If you are really insecure about this transaction then I suggest that you bring a friend or lawyer with you to the notary who can hold your hand through the process.

Any questions or comments are very welcome. Feel free to ask and I’ll try to answer in a timely manner below.

Hi Patrick,

Ive been reading your articles for a few years and recall an article (i think it was yours) talking about a theme within sales o rental contracts in Colombia, where the buyer or lessee can sue the seller or lessor in the future if the value was inflated above market value. Was that your article or are you familiar with that law?

Hey Jack – nope, that wasn’t my article. But Colombians are good negotiators and I have yet to see anyone paying too much. That being said, I would not be surprised if such a law exists.

This is so useful Patrick. During quarantine my mother and her brothers are selling their mother’s house and were very stressed about having to go out and about to get these documents and be exposed to other people. I remembered I had read this post a few months ago, checked out the links today and sure enough, we were able to download all the certificates without an issue. My mother has sold two apartments and bought one here in Cali and she had no idea you could do all this digitally. Needless to say, she’s extremely grateful. Thanks a lot.

Hi, Patrick. Very useful and nicely written article. It really helps to understand the process. Based on your experience, which capital gain tax is applied to non-residents when they sell their property in Colombia? I still can not figure out if it is normal 10% or 35% because they are non-residents. Thanks in advance. Anna

Hi Patrick, I’d like to follow on from Ana’s question about tax. Do you know how the amount of capital gains is calculated? Because it seems as though properties here have two values – the amount actually paid, and the official registered price, with the ‘official’ price being much lower.

I’ve read that DIAN assume you bought it at the low official price but then know how much you really sold it for, meaning that the capital gains appears much higher than it really was? That can’t be right can it?

Hi Ana, I asked my accountant and he confirmed that capital gains tax on real estate is 10% for both residents and non-residents.

Hi Euan,

It was common practice for many years to always sign titles based on the publicly assessed value – the one that appears on the the property tax receipt. This is now illegal, although I’m sure many people still do it. But in order to hide the paper trail they would have to pay the excess part (the difference the sales price and the publicly assessed value) in cash. It serves a big purpose for both seller and buyer because it lowers both notary costs, registration costs and capital gains. BUT, if you’re a foreigner bringing in funds from abroad to buy a property, then you need to register the investment with the central bank – BANREP – and the fines for getting this wrong is up to 200% of the money you bring, meaning it’s hardly worth the risk. At least not as foreigner, although a Colombian seller may try to convince you.

Awesome – glad it helped you out!

Do you have to be present or can you do all of this electronically now? My fiancé is from Cali, but lives in the U.S. now and doesn’t want to travel back in order to sell his house. He has a buyer interested, is there a safe and secure way to do this? He has an account with a bank in Cali already.

Hi Patrick.

My sister and her husband are selling their home in Cali. I’m helping them advertise the home to an international market, because that area is very desired by Americans and Europeans. I want to know if you have knowledge of any websites or companies that are safe and a great way to advertise their home. I’d really appreciate your help.

Thank you so much for this article. I have decided to sell my property in “kilómetro 30”. It is a “casa campestre”. I need someone to help me sell it. Would you have any recommendations?

Thanks!

I’d like to sell my property in Bogota Colombia but it’s really hard to trust people specially in Colombia, good talkers bla bla bla and nothing get done, they just want el tumbe and chao, I’ll get more info but your article is very helpful.

Hi Patrick,

My Mother wants to sell her apartment in Bogota but she is living here in USA with us. Do you know a good reputable real estate company in Bogota that can help us to navigate the Colombian system? I would appreciate it. Thank you.