A couple of months ago, I gave my second speech about visiting, living, and investing in Cali to a group of European and North American retirees and investors at the Live and Invest Overseas conference in Medellin. It’s an annual, weeklong event with up to 8 different speakers presenting each day. Lots of information as I’m sure you can imagine.

I was just there for two days. But something struck me as a big surprise. With all of the interesting content being shared, never in my life had I imagined that the most anticipated presentation was about the options for health insurance in Colombia.

Of course, it had something to do with demographics. The average age at the conference was about 60. Most of the audience came from North America where people are used to paying absurd insurance premiums for access to health care.

As I’m sure that lots of people who did not have access to the conference are equally curious about the healthcare in Colombia, I managed to get a hold of Angela Berrio who is the independent insurance broker who gave the actual presentation. Below, I’ll be picking her brain to help you understand how the health insurance system works in Colombia.

First, there are a couple of things you should know…

In 1991, Colombia drafted a new constitution making access to health care here a basic human right for all citizens and foreign residents.

There are two types of health insurance in Colombia:

- EPS – Entidadas Promotoras de Salud – the public healthcare insurance that is mandatory for everybody. The monthly premium is based on 12.5% of the monthly gross income that you declare to the EPS.

- Prepagada – the private healthcare insurance. The monthly premium varies depending on your age, pre-existing conditions, and the plan you choose.

And without further ado, I’ll let Angela take over and answer my questions.

———————————-

Angela, how good is the health care system in Colombia? Public and private.

Contrary to what many people may not believe, health care in Colombia is actually very good. I’d even call it excellent. 18 of the best-ranked 44 hospitals in Latin America are located in Colombia. And not only is it high-quality, it is also very affordable.

As you know, the system is divided into the EPS and the Prepagada.

The EPS is the government health insurance available to all residents with a “Cedula” (local ID). This is an option for everybody, including people that are NOT eligible for private insurance, where eligibility factors such as age, and pre-existing conditions may disqualify the individual.

It is important to remember that the EPS is only for people that plan to reside permanently in Colombia.

The delivery of services is through a network of public health providers/facilities. Remember that the EPS covers everybody. It’s an obligation to have it. And when the system has to attend to everybody, it means longer waiting time for the patient. In order to see a specialist, run diagnostic exams like x-rays or blood samples or get a surgical procedure done, you will need a referral from your general practitioner. The doctors are usually good, but they will leave you in a room with lots of people and there is no preferential treatment.

In the private sector, there are a number of private health insurance companies in Colombia with insurance plans (Prepagada) available to local residents and non-residents.

The private health insurance is an option for people under the age of 60, and up to 62 with additional premium/requirements. With the Prepagada, you will be serviced through a private network of health care providers and facilities. The focus is on offering efficient, timely, high-quality care.

Some of the key benefits of the Prepagada include:

- Referral is NOT needed for Specialist, Diagnostics, Procedures. You simply call directly to schedule an appointment.

- No time wasted, you will get preferential treatment, private rooms, access to the best doctors in Colombia.

- Travel insurance for up to 90 days on each trip.

- It is also available as a supplemental policy to EPS, offering expanded coverage of specialists/hospitals, allowing for alternative options to address an illness, accident, etc.

I like to say that it’s like traveling on first class.

Can a foreigner get health insurance in Colombia?

Yes, absolutely, and with full coverage. For the Prepagada, though, there are some limitations regarding age, pre-existing conditions such as diabetes, Fibromyalgia, etc.

Do you need to be a resident and have a cédula or is a passport enough?

To sign up for the EPS, you will need to be a temporary or permanent resident with a cedula. For the Prepagada, a passport is enough, but if you’re planning to live permanently in Colombia you will need to get the cedula to do just about everything.

It’s worth noting, that I have American clients with the Prepagada policy, that live in the US. They only go the hospital in the US for emergencies. For the rest they come to Colombia and we give them a discount for opting out of emergency care on the plan here, as they most likely will not need emergency care if they live in the US.

How do the prices compare to the US if someone is not covered by a health insurance but wants to come to Colombia for treatment?

As a rule of thumb, expect that any procedure will cost approximately 1/3 of what you would pay in the US. So let’s just say that a knee surgery in the US would cost $10.000 USD, then in Colombia, you can get the same procedure done for about $3.500 USD. It is also worth noting that many of our doctors graduated from the best schools in the country and are in fact bilingual.

Not that it has anything to do with the health insurance plans, but we are seeing a lot of foreigners coming to Colombia for cosmetic surgery, dental care, etc. Many 5-star medical recovery centers are beginning to pop up, focusing especially on this market. The savings are just too big to ignore and for many people without health insurance, it may be the only viable option for many procedures because prices in North America are so inflated.

What kind of monthly expense should a 25 / 45 / 65-year-old expect for full coverage and access to the best hospitals?

The EPS costs 12.5% of the gross income that you declare to your EPS.

For the prepagada it ranges from $125 – $200 for a 40-year old and a 60-year old, depending on the plan that they opt for.

If you reside in Colombia, then according to the law, you should have the EPS before getting prepagada.

What about people who are older than 60?

Between age 60-62 there is an additional premium and they need to sign up for a family plan with someone younger than 50. After 62, it’s almost impossible to sign up for the Prepagada, but the EPS will still accept you.

Is there a co-payment for every visit to the doctor / emergency care?

Yes, both for the EPS and the Prepagada, there are some small co-payments depending on the type of consultation/treatment that you are getting.

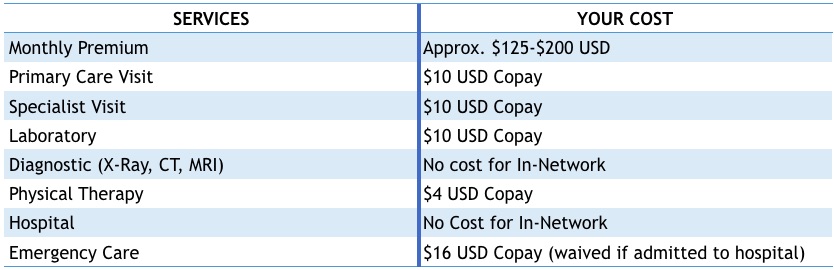

This table below represents the co-payments for the Prepagada. Please note that the dollar value is an estimate based on today’s exchange rate.

The EPS also has some co-payments, most of which are slightly lower, depending on the service.

How long does one have to wait to see a specialist or to receive surgery?

With the EPS, it usually takes a few months to get a an appointment with a specialist and the same to get surgery approved. With the Prepagada, you will receive a booklet listing all of the specialists that are affiliated with the health insurance company. You simply call them directly when needed and normally you will get an appointment within days.

If a specialist recommends surgery, it takes 48 hours to get it approved by the Prepagada.

You are also free to choose any doctor outside the network and most Prepagadas will reimburse you for your visit, deducting only the co-payment.

Any limits to the coverage?

Yes, but it all depends on the insurance company. I prefer to sell SURA because I know that they are the most solvent company and I also know that they take great care of their clients and patients. The feedback it get from people insured by them is simply a lot better.

To check out the coverage of the different plans, SURA’s website is a great place to start. If you have any additional questions or need help translating, then I’d be happy to assist.

Do any of the insurances cover cosmetic surgery?

No, only in case of an accident.

Do any of the insurances cover “extreme” sports like diving, motorcycling, paragliding, etc?

If you do it as a professional every week, we need to declare it as your job and you may have to pay a slight premium, but if it’s just a hobby and something you perform sporadically, then there is no need to declare it. You will be covered in the event of an accident.

What are the steps necessary to get started?

For either the EPS or the Prepagada, your broker will conduct a short interview, need your personal data, select a method of payment form, etc. All combined, it takes no more than 60 minutes and you will receive your approval within 48 hours if it’s the Prepagada. For the EPS, they can not refuse you.

Does the insurance cover a person while traveling outside of Colombia as well?

The EPS has no coverage outside of Colombia.

With the Prepagada, there is a travel insurance included for up to 90 days for each trip with certain limits. But you need to be a permanent resident in Colombia and sign up for the plan with a cedula. If you do not sign up with a cedula, they consider that you already live abroad, and for that reason, there is no coverage, as it is not considered traveling.

How much is the additional cost to add a child younger (minor) than the 18 to the plan?

So the price brackets go as follows…

From age 0-14, 14-40, 40-60, 60-?

Young kids are cheap. Slowly the price increases. Also, the prices will be raised every year according to the IPC – the Colombian inflation index, usually 3-4%.

Are there any benefits to signing up while you are young?

Yes, it is a bit cheaper to get in early, but the difference is really not that big unless you are older than 60.

Does the health insurance companies look at medical records before accepting a client?

No, they don’t ask for it, but if you are over the age of 50 they will perform a medical examination of you before accepting you as a client.

The only other reason that they would ask to see your medical record, is if you declare something serious on the sign-up form. I’d recommend that people talk to me before filling out the form and I will guide them.

You work for SURA – but what other companies are there that offer health care insurance in Colombia?

I’m actually independent, but I prefer to sell SURA because they really do offer the best coverage and I believe that they have the best private clinics. SURA has more than 4600 physicians in their network and more than 400 medical centers and hospitals. They are in my opinion the leaders in the health care insurance business in Colombia.

Other health insurance companies that operate on the Colombian market include Seguros Bolivar, Seguros Falabella, and Coomeva.

How can people reach out to you if they need advice or a quotation?

Angela Berrio

angela.berrio@asesorsura.com

Calls / Whatsapp + 57 318-516-5743

Can you service people all over the country?

Yes, no problem at all. Even if they are abroad. I speak English and we can do everything by telephone and email.

———————————-

As a final note…

I have never worried much about access to health care in my life. Heck, I’m young(ish) and have always felt “indestructible”. Also, I come from a country where everybody has access to amazing health care. But when you have kids and they get viral pneumonia and you need to go to the hospital in the middle of the night, and you do not want to wait to see a doctor… well, then, you realize that maybe you do need to have great medical coverage. So, after a bit of discussing back and forth at home, we’ve signed up for the SURA Prepagada. We have been with them since December 2016. Two times I’ve had to rush to their private clinic by Chipichape in the middle of the night with a sick kid. The treatment we have received every time (so far) has been nothing short of amazing. From entering the door to being in front of a doctor, we have never waited more than 10 minutes from the time of registering at the front desk.

To give you an idea, for a family of 4, we pay $883.000 pesos (currently about $300 USD) per month for our Prepagada. On top of that, we also pay for our EPS.

Please understand that I earn nothing from recommending SURA, I’m just a satisfied customer. As part of your due diligence make sure to review some of the other health insurance providers before choosing which company to sign up with.

If you register yourself as an independent at the EPS, you can quote yourself on the minimum wage of colombia regardless of the foreign income you get, then your monthly contribution is only the minimum which is 92400 pesos or like 33 dollar in 2017.

Is it possible to get private (Prepagada) health insurance in Colombia if you are older than 62?

Is there a ‘third option’ for someone who may not qualify for health insurance, doesn’t want to wait months under the EPS, and can afford to pay the doctor’s bill out of his own pocket?

David – yes – you can always pay as “particular” meaning that they charge you for each consultation, usually $100-150.000 COP.

I am in few weeks getting into a Civil Union with a citizen of Colombia. After that, I am applying for a TP-10 visa. I am at 75 far too old for any private healthcare, so I guess I need to join EPS.

How soon I need to go to EPS? I come from Ecuador, where even a tourist must join healthcare system, either private or IESS.

Does my wife’s EPS cover me right from start of our Civil Union?

@Tomi – I do not think that your wife’s EPS will cover you, but to be completely sure, I suggest that you reach out to

Angela Berrio

angela.berrio@asesorsura.com

Calls / Whatsapp + 57 318-516-5743

She can help you with any questions you may have.

I have been researching EPS as that is the only option for me. I am 70 yrs old with new pensionado M-11 visa. I notice that everyone says “12.5% of of the monthly gross income that you declare to the EPS”. This sort of implies that not everyone declares their full total monthly gross income? You are not asked for proof when you apply? And the EPS system has no ability to cross check or verify to Visa income declaration?

If so, and since the minimum retirement visa income is currently around $781 USD/month (based on 3*Colombian min monthly), then I could perhaps declare $800/mo income or $850 and not be questioned?

I am happy to pay, but I prefer to not pay more than I am currently paying in USA Medicare. Was hoping to be able to drop Medicare and pay to Colombian EPS as more or less even swap.

Many thanks for your advice or opinion on this.

Hi Suzann,

Lots of technical questions. I know several friends who declare on a minimum wage but earn more. The thing is, that in Colombia there’s a huge informal economy with lots of cash transactions that are untraceable for the authorities. If you want better advice, then reach out to Angela – her contact is in the post and she will be able to guide your better than me.

Please update once you have a comment from her. Best, Patrick

best insurance for over 70 for expat. i want the best care at any price

Thanks for the information so far .

I have a family that my wife supports in the form of a charity from our church and I would like to know where I can get them Healthcare the mother 28 and does not work the child is 6 years old they live in Bucaramanga, Santander,Colombia

My wife and I are new at this insurance type stuff so any help that you could give me companies to contact rates at me bi prices at maybe I don’t know what information you can supply but any will be greatly appreciated thank you Lloyd

Does this 12.5% cover a spouse? Are do both husband and wife needs to pay a total of 25% of their income for EPS coverage?

There are certain conditions where you can be a beneficiary of your spouse’s medical insurance. But better ask Angela as she will be better suited to answer. I know that I pay 12.5% of my salary to EPS and so does my wife. Additionally we have a family plan for the Medicina Prepagada.