Here’s what I wrote in bullet point 8 in my original article on how to earn dollars in Colombia.

“Daytrade. The US market is the most liquid and easiest to trade. Personally, I sell put options on stocks and collect between $1-2.000 dollars per month doing so. I use Interactive Brokers. They have the cheapest commissions, but are a little more complicated to use. For a list of good brokers, check out Barron’s article on the subject. It’s not hard to do and you can find YouTube videos that explain the process. If you prefer reading, High Income Retirement by Dr. David Eifrig Jr. offers a great guide and was my inspiration to get started. The trick is to only sell put options on securities that you would like to own at a price that you are happy to pay.”

This is the dollar-earning idea that I have gotten the most feedback on. I have received a ton of questions on how to get started, how the stock market works, etc. While it is impossible for me to explain all of the potential strategies for daytrading the stock market, I’ll try to be as specific as possible about the ways that I do my trading.

The ideas presented below offer the most powerful approach, that I know of, to consistently earn money in the financial markets. Like anything else it does require some basic understanding of how the markets work. If you have no interest in educating yourself, then stop here and save yourself the next 15-minute read.

Although I call it daytrading, I probably only make somewhere between 10-20 trades a month. A lot less than most people who call themselves daytraders, and a heck of a lot less than the computers described in Flash Boys by Michael Lewis, that make thousands of trades per second.

I usually spend about 30 minutes to an hour, 3-4 days a week looking at the market and trying to spot a good setup for a trade. Then I use the Stocks app that comes with the iPhone to screen my positions for about 5 minutes, twice a day. That’s it.

Options trading

You can daytrade the stock market, a phenomena known as scalp trading, where you use technical indicators to determine whether the market is over-bought or over-sold, and make a bet in the opposite direction. The goal is to earn a few basis points on each trade. Usually you’ll be out of the trade within a few hours, sometimes you’ll hold a position overnight.

To be honest, I’ve never been very successful in this type of trading. You will need to dedicate a lot of capital in order to make this type of trading successful. And you will need to dedicate most of your day to watching the markets. Not my style at all, so I’ve decided to dedicate myself to a different kind of trading, called options trading.

Options are an unknown area for many retail investors. It’s a market that operate parallel to the stock market and is controlled by the CBOE – the Chicago Board Options Exchange.

The easiest way to explain options trading is by comparing it to an insurance market for stocks. Although options often get described as extremely risky, they were actually created to reduce risk. Individual investors, hedge funds and large institutions trade options, oftentimes, to protect their portfolios. When used correctly, I consider them way safer and a lot less risky than buying stocks outright. In fact, I even use them to buy stocks at a discount, as I will explain below.

Two types of options

Before getting started you will need to be familiar with a few terms related to options trading:

- Each option is a contract. One contract covers 100 shares of a given stock.

- The option premium is the price of the option.

- The strike price is the price in question for the stock that the option covers.

- All option contracts are limited in time. The expiration date tells you when that is.

There are two types of options and you can buy or sell either one on the financial markets. Here’s a quick overview of the four possible trades.

Call options give the owner the right, but not the obligation, to buy a stock at a given price within a certain timeframe.

- If you think a stock is going to rise in price, you can buy a call option to gain from the potential move. Let’s say that Intel’s stock is trading at $29 a share, but you think it will rise to $33 by the end of October. To speculate on this rise in price you can buy the Intel $29 call option that expires on October 23, for $115 – the equivalent of paying $1.15 a share for this right.

If it turns out that your analysis was correct and Intel trades around $33 dollar by the end of October, you can buy the shares at $29 and sell them $33. Your profit will be $2900 + $115 – $3300 = $285 per contract. You can also just sell the option, which would have risen in price from $115 to around $400, leaving you with about the same profit. - If you already own 100 shares of a stock you can sell calls – a trade known as selling covered calls. It is a strategy used to generate income on existing stock positions. Using the Intel stock as our example, let’s say that you own 100 shares of Intel stock, trading at $29. You can then sell the Intel October 23 $30 call option for $80. The buyer of the option will have the right – but not the obligation – to buy your Intel shares for $30 a share before option expiration in October. If the shares stay below $30, the option will expire worthless and the $80 premium that you received upfront is yours to keep. You can now sell a new set of covered calls against your shares.

Put options give the owner the right, but not the obligation, to sell a stock at a given price within a certain timeframe.

- If you already own a stock and are afraid that it might move lower, you can buy a put option to protect your position. Using the Intel example, with the shares trading a $29, you can buy an Intel October 23 $29 put option to protect those shares for $105. If the shares fall to $25 by the end of October you will have the right – but not the obligation – to sell your shares for $29 before option expiration on October 23.

- If you would like to own a stock, you can sell a put option to in order to get a cheaper entry point than the current price in the market. By selling the above mentioned October 23 $29 put option on Intel, you will be owning Intel at option expiration if the stock trades below $29. Your breakeven price will be $29 – $1.05 = $27.95 per share. That’s 3.6% cheaper than the market price at the time of selling the put.

If the Intel stock trades above $29 by the time of expiration, the option will expire worthless and you get to keep the $105 in premium.

Each option consists of a 15-20 ticker code. Here’s an example: AAPL151023P00113000.

The first letters AAPL refers to the stock ticker, in this case Apple, known as AAPL on the stock exchange. The following 6 digits are the expiration date, 151023, October 23, 2015. The letter P is for “put” option (would have been a C for a call option, and the final digits are the strike price, in this case 00113000, $113 dollars.

Most options expire on the third Friday of a given month, although highly liquid stocks, like Intel, may have several contracts with different expirations for each month.

Option premiums are based on the current price of the stock, the time to expiration and market volatility.

Stock prices are quoted on Bloomberg, Yahoo! Finance, etc.

The further out in the future the option expiration date is, the higher a premium the option commands. This is known as the time premium.

When market volatility, known as the VIX, is high, then so are the premiums, and vice versa. A volatility score under 20 is considered low. A very high score, like we saw during the financial crisis in ’08, is above 80. It makes sense… in uncertain times, people pay more for insurance.

How I trade options

The above was the basics. Although there are only 4 ways to trade options, there must be at least 100 different strategies. Every trader use them differently. There is no way that I will be able to cover all the different strategies in one blog post, so I’ll stick to what works for me.

I consider myself a very conservative investor. I sell put options on great businesses and covered calls against the stocks if I get assigned the stock. I actually consider this to be a lot less risky than buying stocks outright, because by selling put options I get a lower entry price. In the case that I get “put” a stock I’m happy. It usually means that I’ve gotten the shares for less than I was originally willing to pay for them. Here’s why… and this is very important:

I only sell options on great businesses that I am happy to own, at prices that I am happy to pay!

It’s the only thing that works (for me at least) in the long run. Once in a while I will play with some of my gains and buy a speculative call option on a volatile gold miner.. Sometimes it works out, but most times I lose all my money, and I realize that I should stick to my original strategy of just selling puts on great companies.

How to identify a great business

The most important rule when selling put options is to only sell them on high-quality businesses that you would be happy to own at the agreed upon strike price of the option contract.

In order to stick with this discipline you will need to learn how to identify a great business when you see one. Porter Stansberry, founder of Stansberry Research, is my mentor. He doesn’t know it, but he is. He has taught me how to quickly identify a great business, selling at a fair price, by doing five simple calculations:

(You can find all of the numbers that you need for the following calculations on the Yahoo! Finance page)

- Cash operating margin greater than 20%: Cash from operations / revenue.

- Shareholder payout ratio greater than 1: Capital returned to shareholder via dividends and share buyback / Capital expenditures.

- Return on invested capital greater than 20%: Net income / Debt (short/current + long term debt) + shareholder equity.

- Return on tangible assets greater than 20%: Net income / Net tangible assets.

- Share price multiple less than 10: Enterprise value (Market cap + debt – cash) / EBITDA.

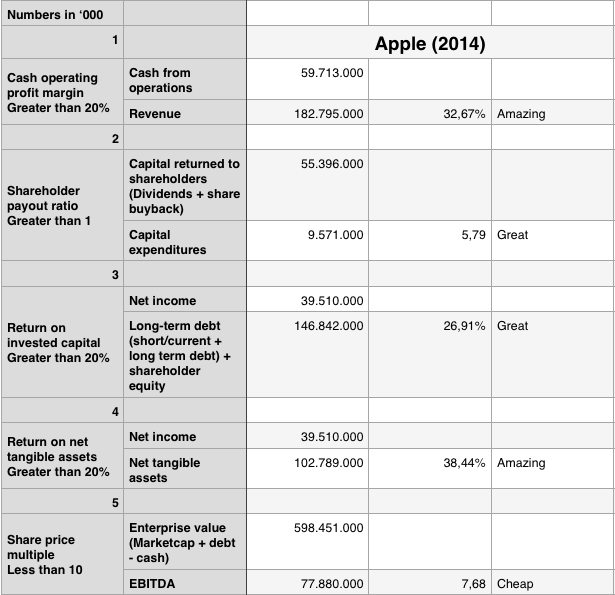

I keep a spreadsheet where I calculate these five metrics for a range of companies to determine which ones to sell put options on. One of the companies that I use for my put selling is Apple. Here’s an example of what those calculations look like.

As you can see, Apple complies with all of my five criteria, so I’m happy to be selling put options on its stock. Even if I end up getting “put” the stock, I know that I will be owning a great company at a very fair price.

(Please note that the numbers might have changed slightly since I did my calculations a few weeks ago.)

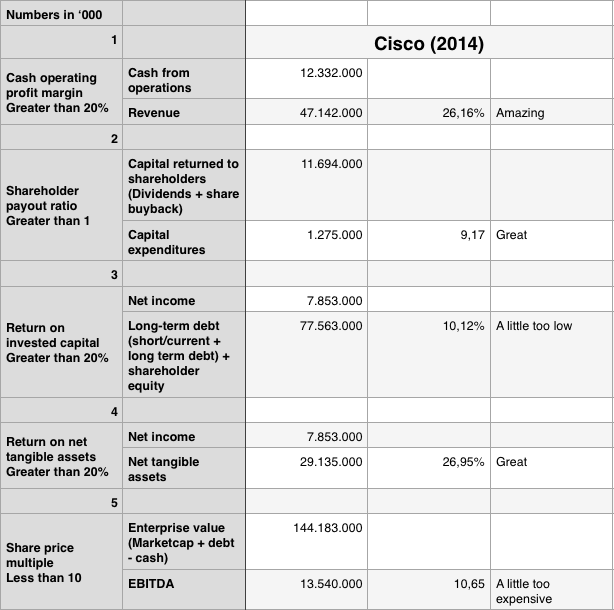

Here’s a another example. Take a look at Cisco’s numbers.

As you can see, Cisco does not offer the same impressing metrics as Apple. Very few companies do. In many ways, though, it’s a still a great business. Their return on invested capital is a little too low and the shares are a tiny notch too expensive, but I’d still be OK with selling put options against their stock.

All you really need is to identify 10-20 businesses with great metrics. Once you’ve found them, you can keep selling options against the same stocks over and over again. Don’t be fanatic, but apply common sense, study the business and you should be fine.

If you were planning to buy the stock outright anyways, you might as well sell a put option to get a cheaper entry price.

With thousands of stocks trading on US stock exchanges it can be hard to know where to begin your search. Dividend Aristocrats are a good place to look for great businesses, although many of them are often too expensive (trading at high share price multiples) to serve as good candidates for put selling. Magic Formula Investing, a stock screener by Joel Greenblatt, author of The Little Book That Still Beats The Market, is another good place to begin your search. Signing up for a few stock picking newsletters is a third place to get inspiration. On my resource page I have listed my favorites.

A practical example

Continuing with the Apple stock, here’s an example of how you can play this trade.

On September 29, 2015 the AAPL stock is trading for $109.06 a share. To figure out what option to sell, I click on the “Options” link on the left sidebar on Yahoo! Finance page for AAPL.

I prefer short term trades, usually with less than 2 months option option expiration. Here’s that I found:

The October 23 AAPL $109 puts are selling for $425. Remember that each contract covers 100 shares. For taking on a $10.900 obligation by October 23rd, you will be paid $425 in option premium.

3 scenarios

- The stock stays above $109 by October 23rd and the option expires worthless. You get to keep the $425 that you received as premium for selling your put option. You can then sell a new set of options against Apple’s shares. That comes out to a 3,89% return on capital in less than a month or 59% annualized gain. Not bad at all.

- The stock falls below $109 by October 23rd and you be will “put” (assigned) – the 100 Apple stock that each contract covers. The interesting part is, that you own the stock for less, because your entry price is only $104.75. ($10.900 – $425 that you received upfront in option premium divided by 100 shares). That’s 4% below the strike price. As long as the stock stays above $104.75 you will still be profitable on your trade. You can now either sell the stock or begin selling covered calls against your stock for further income generation (explained below).

- The stock drops below $104.75 by October 23rd. You will now be assigned the stock and you’re looking at a potential loss. Here’s the beauty of this strategy: You can now use your shares to begin selling covered calls and generate income. Let’s just say that the Apple stock dropped to $103 by October 23rd and you get the 100 shares assigned at $109 a piece. The following Monday you could sell a covered call option against your stock. The November 20th $105 covered calls would probably be selling for around $400, lowering your entry price to $100.40 per share (($10.900 – $425 – $400) /100). If by November 20th the stock trades above $105 you keep the premium that you received, but your shares will be called away, leaving you with a $460 profit. If the shares trade below $105, the covered call option will expire worthless and you get to keep the premium, and have the opportunity to sell a new set of options against your shares.

You can almost always turn this strategy into a winner, especially if you stick to only selling put options against the shares of great businesses that you are happy to own at the given strike price. Your biggest threat are big one-day drops in the market, like what happened in ’87, ’00 and ’08. If you can’t stomach that kind of risk, it’s better not to be in the market at all.

When you sell a put option, your broker will “lock” the money in your account as long as you are obligated by the option. If you sell it before time, your funds will automatically be released.

I realize that committing $10.900 dollars to one trade might be a big mouthful for many people. Do not despair. Trading a company like Cisco, mentioned above, is way more feasible. Each share trades around $26 at the moment, meaning that you would need only $2.600 to sell a Cisco put contract.

Trading on margin

A lot of brokers allow their clients to trade on margin. It’s kind of like trading on steroids. I don’t do it, and I don’t recommend that you do it either, unless you are a very experienced and well-capitalized trader.

It works like this:

Instead of “locking” 100% of the cash for the put obligation in your account, your broker will only lock 20% of the required capital in a margin account. Trading on margin and you will be able to do 5 times as many trades as you could if you’re trading without a margin account. It’s a lot of fun, until you have a trade that goes against you, and all your money is tied up in different positions. You will then be forced to liquidate positions, potentially at a loss, to cover your margin trades. No fun at all.

Don’t worry – you won’t accidentally end up trading on margin. Being approved for this involves a looong separate contract with lots of signatures before your broker will allow you complete these trades.

Tools

You can trade options online through most American discount brokers. By default, your account is not authorized to complete these trades. In order to get the approval to begin trading, you will need to fill out an “Options Account” form. In most cases the form will be available online.

I’m not an American, but Interactive Brokers accept international clients as well. For list of recommended brokers, check out Barron’s article on the subject.

High Income Retirement by Dr. David Eifrig Jr. is the best book I have ever read on the subject of selling put options. I highly recommend that you check it out.

You will need at least $15-20.000 dollars in your account before selling put options gets really attractive. With $20.000 in your trading account, you should be able to safely generate up to $1.000 dollars per month in additional income. That’s 5% a month or 60% a year. And the best part is, that you will be doing so without taking excessive risk or committing your entire day to monitoring the markets.

On my resource page, I’ve listed all of the tools that I use for my trading.

A final word

The strategies above are extremely powerful. Like I said, it is the only way that I have found myself consistently winning in the market. As tempting as it is, I don’t suggest that you rush out to open a brokerage account and start trading options. I know that this might be a terrible analogy, but if you’re genuinely interested in learning these skills, try to treat it like your first visit to the casino. Before putting any money on the table, you should spend a little time observing the games, watching the players (gamblers), learning the terms and so forth. That’s what I’d recommend that you do.

The first thing you should do is begin to build your list of great businesses.

Once you’ve identified a few that you feel are worthy of trading options on, you should make yourself a spreadsheet and start recording some fictional trades. Do this for a few months. Once you fell comfortable, then start with one put trade. Wait until it expires and see what happens. Get a feel for it. Keep learning. I promise you that it will be worth it.

If there are at least 10 people who would want to learn, I’d could put together an option trading seminar, teaching this above in more depth while also exploring different strategies.

As always, I would love to hear your thoughts on the above. Comments and questions are more than welcome!

(Photo credits: By Rafael Matsunaga (Flickr) [CC BY 2.0 (http://creativecommons.org/licenses/by/2.0)], via Wikimedia Commons)

Do you offer teach people how to trade futures as well? If so what kind of stuff do you trade?

I thought about opening an account with Interactive Brokers but ended up going with TradeStation because I found IB’s customer service to be very slow and also because all my trading friends tell me how much more technically advance the TS platform is.

Hi Steven,

No – I don’t deal in futures at all.

I’m not praising Interactive Brokers. Their platform can actually be quite complicated to use. I use them mainly because they are one of only a few companies that allow non-US citizens to sign up to trade US options.

Thanks, Patrick

This is a good strategy in a bull / flat market. Bad in a Bear market, but the opposite could be applied in trading strategy.

How has this strategy worked for you this month?

If you want to get more advanced, you can begin to look at RSI and MACD to help determine if the market is over-bought or over-sold in the short term. When it’s overbought, it’s a great time to sell covered calls. When it’s oversold, it’s a great time to sell uncovered puts. A higher VIX (volatility) gives you higher options premiums.

To be honest, some of my positions are slightly down, but in my case, it doesn’t matter because I’ve been collecting so much premium upfront. Also, you have to remember the most important rule: ONLY sell puts on companies that you are happy to own at a price you’re willing to pay. You have to do your homework in selecting those businesses. Also, even though we might be seeing the beginning of a bear market, some stocks will always outperform. Some of my positions, like COH, MCD, etc. are actually up over 20% over the last couple of weeks. A 20% move in a stock can easily become a 2-500% move in the option.

Hope this helps,

Patrick

Hi Patrick,

Loving all the information- your website is heaven sent!

Have you tried currency trading? And what’s your opinion on it?

Thanks!

Rhianne

Thank you Rhianne.

Never tried currency trading.. I know there are money to be made, but personally, it would just been too much information to keep track of in my little head and too depending on politics which I don’t want to spend my life trying to analyze.

Hey Patrick,

First of all, amazing article, amazing website. I binge read at least 15 articles the past few hours. This one def gave me motivation to dig more into option trading!

I’m currently trying to set up an account with TD Ameritrade to trade US stocks (mainly Penny Stocks) and I was wondering how you dealt with taxes. You (just like me – German) are a nonresident alien, residing in Colombia that currently has no tax treaty with the US. Do you let things run via your Danish accounts?

I’d highly appreciate a quick elaboration! ..and any tips are welcome!

Cheers from Honda, Tolima (in love with this place),

Nils

PM sent

Hi Patrick,

I really liked your blog, arrived for the budget living in Cali for 2k a month and i was quite impressed so started wandering around until i arrived to this post.

This is subject i have been interested for a long time, I work around the world, but live in Cali-Colombia every 2 months for 2 weeks. I was trying to setup an account in different webpages like ameritrade and etrade, but all of them asked for an US Tax ID, as Nils before me i am interested on how can i do this but with a Colombian citizenship.

I highly appreciate some tips on it.

Cheers from Kazhakstan!

Hello Patrick,

I just moved to Medillin with my wife, I have been trading in California, US for 3 years and understand the tax laws but I’m a little confused on what taxs to pay living here in Colombia now. I am a resident here and was able to.set up an account with IB using my bancolombia account. But before I start trading I wanted to know what % of my earnings I need to put into a savings account to pay taxs at the end of the year like I do in the US. Also will.I have to pay both US and Colombia taxs now? Also do you trade any latin american markets and are those taxs lower than trading the NYSE? Please e mail me to communicate more. I’m looking to day trade full time in Colombia but just want to get all my ducks in a row before I start.

What are your favorite companions to sell puts on?

@Stephen, I look for undervalued blue-chip companies. RL and AXP were recently very good choices. MSFT, ORCL, INTC, WMT, TRGT, KO, SBUX, COH, DIS, MU all work. A company like FCX looks really good at the moment after the recent correction, but it’s a big higher risk. In general, commodity stocks are for people who can stomach a bit more volatility, but historically, commodities have only sold for such a discount very few times as we are seeing right now. UAA is another one that looks cheap. Hope this helps.

Awesome, thanks Patrick. If I ever get down to Cali I’ll buy you a beer.

Another questions is how do I read these options tables? I’m looking at Apple on the options table.

So for the 187.50 call option the bid price is .71 and the ask is .76. It has an open interest of 12,600. And it’s up over 1000 percent! Am I understanding this correctly?

https://finance.yahoo.com/quote/AAPL180511C00187500?p=AAPL180511C00187500

So if I wanted to buy one contract on this call option I’d have to pony up 71 dollars, correct? And how much would I stand to gain once it hit the strike price?

Oh and anywhere you might recommend to paper trade?

Stephen, sorry I saw this too late and the option chain is no longer available. Please send me your questions to patrick@caliadventurer.com and I’ll try to get back to you faster.